Movie Case Study

The scene that you just saw is from the movie Rocket Singh. In the movie Rocket, Singh’s character is played by Ranbir Kapoor. He finds himself in a job where he is continuously humiliated by his seniors and boss for doing the ethically right thing.

After a lot of frustration and anger, he decides to form his own company ‘Rocket Sales Corporation’ while continuing to work in his current company. The scene depicts how Harpreet Singh is recording all expenses related to paper, printer cartridges, electricity, phone calls, ink, etc. This is mainly because every company makes a profit or loss account or an income statement. Learning Perspectives will explore the meaning of profit and loss account in this blog.

Profit and Loss Account

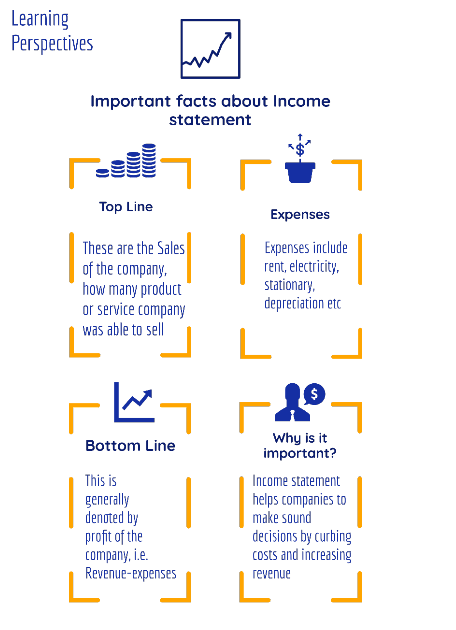

As the name suggests income statement helps in finding out the profit or loss of the company during a particular period. The top line of the income statement/Profit & loss account indicates the revenue or sales of the company, below this all expenses that the company incurs are recorded.

If sales/ revenue is more than the expenses then profit is recorded by the company but if expenses are more than the sales/revenue, then the loss is reported.

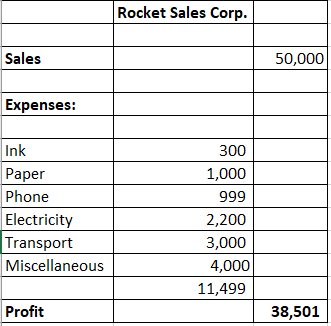

Format of Income Statement

Here Rs. 50,000 of Sales/ revenue is reported while expenses are reported for Rs. 11,499. Hence giving a profit of Rs. 38,501.

Resources of the company that Harpreet Singh would be using such as ink, paper, etc., he says that he would return to the owner along with interest.

Important Facts about Income Statement

Understand Income Statement with a Video

[…] is a part of Income statement or the P&L account. It is an acronym which stands for Earnings before interest, taxes, depreciation and […]

[…] of the company. It is called the top line because it is the first line item in the profit & loss account .Net income is the bottom-line of the company, i.e. Sales/Revenue-cost (Expenses are deducted from […]

[…] a self-employed individual, he/she needs to submit business license details, P&L and balance sheet details of the company, income tax return (ITR) for the last 3 years, license of […]

[…] understands money because it is universally available. All the financial statements such as income statement, balance sheet, cash flow statement are all presented in terms of […]

[…] company can do this by overstating revenues or not recording expenses. This could be vice-versa too. It depends on the intent of the fraud. In majority of cases, it is […]

[…] goods. For example: flour in a cake, wood in a chair or wood in a chair. These are shown in the income statement under Cost of goods […]

[…] This cost is usually shown under the Selling & general administration costs (SG&A) in the income statement of the […]

[…] are recorded in the books of accounts in the income statement. Under the cash accounting system, expenses are recorded as soon as the expenses are paid. While […]

[…] expenses are large in nature and are reported in the income statement of the company. Rent expenses are debited to the profit and loss account or the income […]

[…] than the revenue/sales of the company. This is reflected on the financial statement called the income statement or profit or loss report of the […]

[…] 3 year’s Income tax returns are checked along with last three years’ balance sheet, P&L’s and cash flows. Checking for the stability of company is important. Deeply understanding the […]

[…] or net income is reported in the income statement of the company. It is also called the profit & loss account. The top line of the income statement indicates […]