Movie Case Study

The scene that you saw shows Dev Khanna (played by Arjun Rampal) convincing his father to shut down the factory at Palampur. He says that the factory is running in losses. His father on the other hand believes that many people are earning their livelihood because of his factory and shouldn’t be closed. Dev mentions a plan to investigate the causes of losses in the company.

In this blog, Learning Perspectives will explore the meaning of Net losses.

What are Net Losses?

Net loss occurs when expenses are higher than the revenue/sales of the company. This is reflected on the financial statement called the income statement or profit or loss report of the company.

A company that reports a net loss does not pay tax on it. This happens because the company isn’t earning any income in that particular period. Many companies adopt malpractices to escape payment towards taxes. While some report profit to hide their losses to be respected in the eyes of lenders and shareholders. Cases that are caught by auditors are generally reported as accounting frauds.

Causes of Losses:

Losses occur due to many factors, some of which are as follows:

1. A common cause is fewer sales or revenue in the company. This occurs due to ineffective marketing campaigns, strong competition, unsuccessful pricing strategies, poor advertising, and unresponsive customer service. There can be many reasons why a company may not be able to drive sales. Hence an efficient strategy should be in place to drive revenue.

2. Another cause could be higher costs. This is especially true for a manufacturing company where the company incurs higher costs of goods sold (COGS).

3 Excessive carrying costs contribute to the net losses of a company. These costs are used to carry inventory (finished goods) till the time they are sold or converted into revenue.

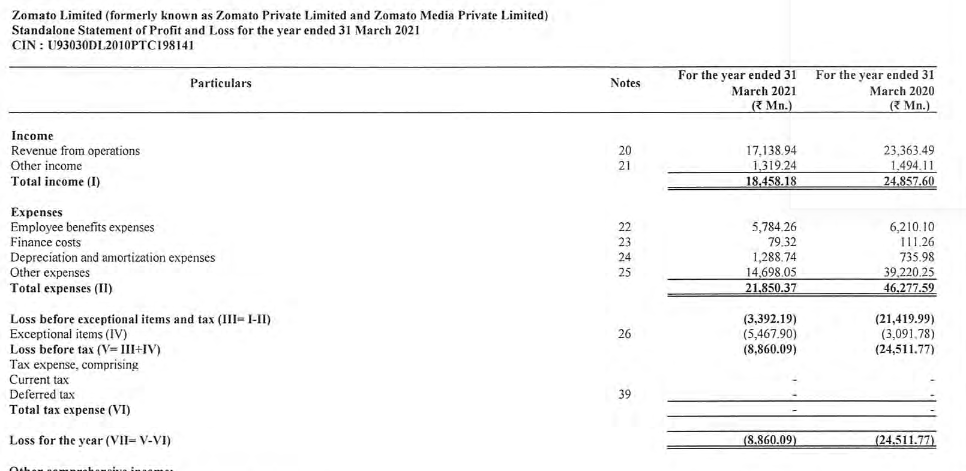

Real-Life Example: Zomato

Attached above is the income statement of Zomato Pvt. limited for the period ending 2021. In this case, one can clearly see the revenue or sales of the year as Rs. 18,458 million which has come down from last year by 26%.

We can see the expenses of the company stands at Rs. 21,850 million. It is a clear case of loss as expenses are greater than revenue. After the addition of exceptional items, we can see the loss of the company stands at Rs. 8,860.09 million. Brackets in accounts signify a negative number.

References: https://b.zmtcdn.com/data/file_assets/9b19fcc148561308ec05ebc83b64cbf91625585052.pdf

[…] for interest payment when it goes into losses. It can have negative net worth when it is suffering losses. This can lead to bankruptcy and winding up of the company. While this can be a disadvantage for […]