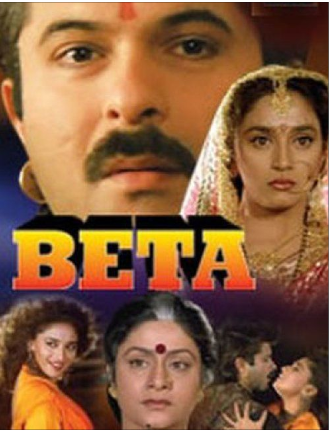

Case Breakdown: Movie Beta

The scene that you just saw shows how Raju (played by Anil Kapoor) is shouting at the accountant (Munim) to explain to him the loss in the books of accounts of Rs. 2,00,000. The accountant says that the loss occurred due to a fire in the warehouse. Raju accuses the accountant of fraud as there was no fire accident in the company. The accountant clarifies that it was not him but Totaram (played by Anupam Kher) who had influenced him to change the accounts.

What is Accounting fraud?

Accounting frauds are characterized by manipulating financial statements. This is done to create a false image of the company. It could either depict the good or bad health of the company to benefit some people. It can mislead all the investors, shareholders, lenders, employees, etc.

A company can do this by overstating revenues or not recording expenses. This could be vice-versa too. It depends on the intent of the fraud. In the majority of cases, it is to make money but it could also be a case of misleading investors and lenders to get more capital. Many times companies are under pressure to maintain capital adequacy ratio and they may also resort to manipulating the figures of the company.

Real-Life Example- Satyam Scandal:

Satyam case is a classic example of accounting fraud. Satyam computer service company came into existence in 1987. Ramalinga Raju was the founder of the company. It became successful quite quickly. The share price of Satyam in January 2003 was close to Rs. 138 which shot up to Rs. 526.25 in March 2008. This was a 300% increase and compounded annual growth rate of operating profit was 35%. The net worth of the company was $2.1 billion.

Ironical to the name of the company (Satyam means truth in Sanskrit), Ramalinga Raju started cooking the books. He falsified accounts for 7 years straight. This included overstating revenue, which meant showing revenue that was non-existent through counterfeit receipts. Price Waterhouse Coopers (PWC) were the auditors of the company but they did not do a good job of uncovering the Satya(m).

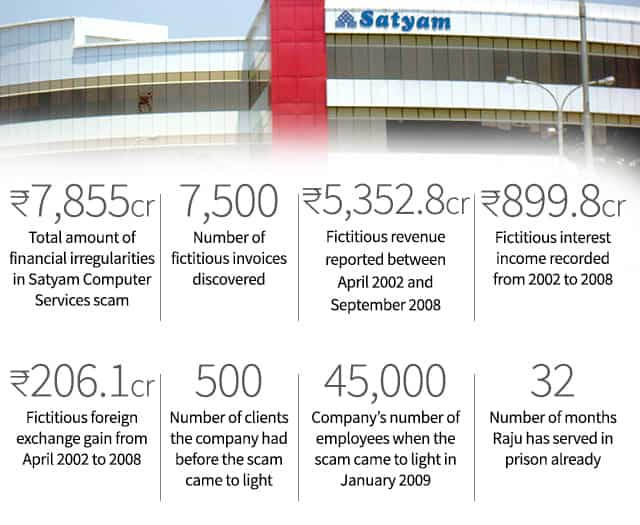

This is a Hindustan times report from 2009.

Uncovering of Staya:

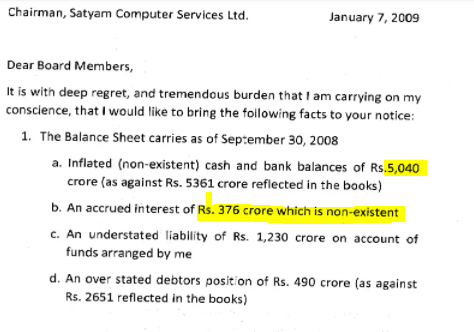

He was left with no choice when the board of directors refused to invest in Maytas (mirror name of Satyam). Maytas was a company his family had created. The idea was to merge with the company and their assets and liabilities can be taken to cover Satyam. In 2009, Ramalinga Raju confessed to the entire fraud that he had committed. Below is a snapshot of the letter he wrote:

As one can clearly see, As of September 30, 2008 means in the balance sheet of September 2008, he had shown non-existent cash of Rs. 5,040 crores as against 5,361 reflected in the books. This means that Rs. 321 crore is fictitious (Rs. 5,361-5,040). Debtors are assets of a company, the balance sheet showed overstated debtors at Rs. 2,651 crores. This is a 5-page letter in which Ramalinga Raju takes complete responsibility for the fraud.

After this letter, SEBI sprung into action and removed Satyam from Sensex, and the Central Bureau of Investigation (CBI) took over the case.

References:

[…] come in when they have to investigate suspicious activities that are related to embezzlement, fraud, tax evasion, money laundering, etc. They work in close proximity with the legal […]

[…] A company that reports a net loss does not pay tax on it. This happens because the company isn’t earning any income in that particular period. Many companies adopt malpractices to escape payment towards taxes. While some report profit to hide their losses to be respected in the eyes of lenders and shareholders. Cases that are caught by auditors are generally reported as accounting frauds. […]

[…] Fraud/Forgery […]