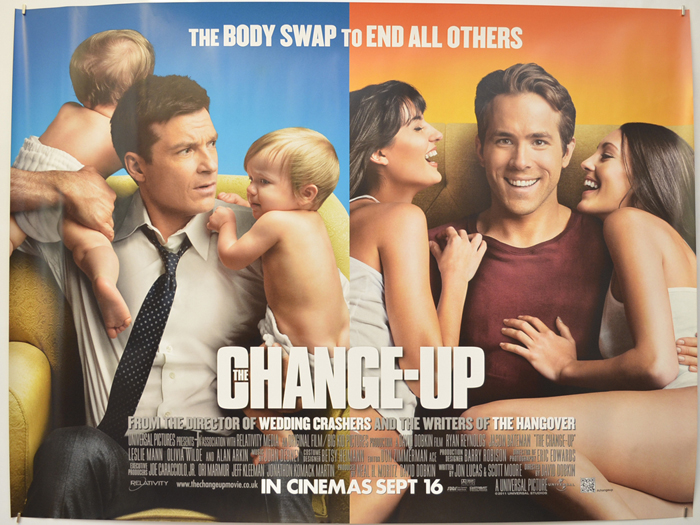

Movie Case Study

If you see this scene carefully, the actor is being asked about EBITDA. There has been some change-up and the actor isn’t knowledgeable about what is EBITDA. So when asked about it, he replies by saying it is good and then he says it is bad. There is a merger taking place and the board is looking for some figures rather than adjectives. This blog, Learning Perspectives will explore the meaning of EBITDA.

What is EBITDA?

EBITDA is a part of the Income statement or the P&L account. It is an acronym that stands for Earnings before interest, taxes, depreciation, and Amortization.

It is a metric that shows the company’s fundamental operating performance and profitability where

I = Interest

T= Taxes

D=Depreciation

A= Amortization

Lets’ understand this with an example:

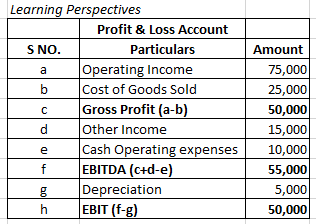

Above is a sample of a profit& loss account. It starts with

a) Operating income:

Income derived from the core activity of the business is described as the operating income of the business. For example for a shampoo manufacturing company, selling shampoo is the core activity, income received from selling shampoo is operating income.

b) Cost of goods sold:

It takes into account only those costs that are related to the production of the goods sold by the company. It includes only direct costs.

c) Gross profit:

Cost is deducted from income to get to gross profit. Gross profit is purely from operating activity hence other income doesn’t form a part of it.

d) Other income:

This is the income that is derived from other activities besides the core activity such as interest income from investments.

e) Cash operating expenses:

This is the cost that is incurred in the normal course of the business. Hence these expenses include selling, general and administrative expenses, management and labor costs, etc.

f) Earnings before interest, taxes, interest, depreciation, and amortization

This is calculated as follows:

Gross Profit+Other Income- Cash Operating Expenses= EBITDA

A higher EBITDA is better than a lower EBITDA, similar to the scene that you just saw, if the actor would have elaborated after saying that EBITDA is good, he could have saved face in the meeting. Good EBITDA can be determined by comparing it to the other players in the industry.

g) Depreciation:

Depreciation represents the wear and tear of the machinery that is used by the company. Amortization is a reduction in the value of intangible assets. They both are non-cash operating exp of the company Depreciation is generally charged on fixed assets and amortization is charged on intangible assets such as goodwill.

h) Earnings before interest and Taxes:

EBIT or Earnings before interest and taxes is a very important metric, this is also called net income or the bottom line of the company.

EBITDA margin= EBITDA/Total Revenue

This margin calculates the percentage of EBITDA to the total revenue of the company and it measures the cash profit of the company in a particular year. This ratio should be used in conjunction with other ratios to better understand the health of the company.

[…] see total net revenue of the company in 2019 is $4,720,227. Operating Profit stands at $652,050, EBIT at $594,210 and Net Earnings or bottom line is […]

[…] related to the core activity of the business. These expenses are not used in the calculation of EBIT. For example: Interest expenses, lawsuit expenses […]

[…] value is calculated through its revenues. All associated costs are deducted from the sales and EBIT is calculated. Further, all taxes are deducted. Brand value is the net present value which is […]