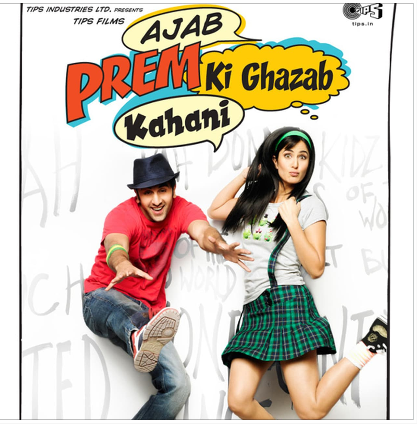

Movie Case Study

The scene depicts Prem’s (played by Ranbir Kapoor) friends’ convincing him to rent out a flat. This would enable them to earn a commission on it. In the very next scene, Prem and his friends try to rent out the flat to Pintoo uncle and he takes the flat on rent.

In this blog, Learning Perspectives will explore the meaning of rent expenses.

What are Rent Expenses?

The total cost of using a rental property is known as the rent expenses. In an organization, the cost of these rented properties is shown in the reporting period. Rent is paid to the owner of the property on a monthly basis. Organizations can take property on lease as well.

These expenses are large in nature and are reported in the income statement of the company. Rent expenses are debited to the profit and loss account or the income statement.

Rent in Advance

Many times, organizations pay the rent in advance, which means the rent of the office or a building is paid in a lump sum to the owner. This advanced rent becomes an income for the owner. This is true, even when the situation is reversed. That is when the organizations receive rent in advance for their property. They record it as a prepaid asset.

Deferred Rent

Deferred Rent takes place when the company is given one or more free periods mostly in the case of a lease agreement. For example: in a 1-year lease agreement, the first month is free, with a rent of Rs. 10,000 per month. Then the total cost of the lease would be Rs. 10,000*11= Rs. 110,000

Expenses that would be charged to the income statement would be Rs. 110,000/12= Rs. 9,167. Now, irrespective of the payment of Rs. 9,167 would be debited to the profit and loss account even for the first month.

Journal Entries:

Let’s understand how the journal entries for rent look.

When a company paid a rent of Rs.60,000 in advance for the entire year (Rs. 5,000 per month) on 1st January 2020. Here the entry will be:

01/01/2020 Prepaid Rent A/c Dr. 60,000

To Cash 60,000

Prepaid rent A/c is an asset account and Rs. 60,000 is recorded here because 60,000 will act as an asset on 1st January as Rent for the entire year has been paid.

The benefits of using the rented space occur evenly over time, with 1 month’s cost attributable to January, February, March, and so on. Let’s say that Rs. 60,000 is paid on 1st January 2020. As January expires, Rs. 5,000 also expires, hence on 31st January entry will be:

31/01/2020 Rent Expenses A/c Dr. 5,000

To Prepaid Rent 5,000

[…] Payment of Rents […]

[…] businesses, it is quite normal to receive and give payments in advance. A business owner can pay rent and insurance in advance and can receive money from clients in […]