Case breakdown: Movie Bawarchi

The scene that you just saw shows how an office colleague of Ramnath Sharma (played by A.K Hangal) is unable to tally the balance sheet.

Ramnath Sharma helps him by tallying the balance sheet and colleagues’ job is saved. This blog, Learning Perspectives will explore how to tally a balance sheet.

What is a Balance Sheet?

The balance sheet is the main financial statement of the company. It shows the financial position of the company. This is in terms of resources (assets) the company owns and what the company owes (liabilities). It also shows the money of the owner (shareholders’ equity). As the name suggests, the balance sheet is supposed to be balanced.

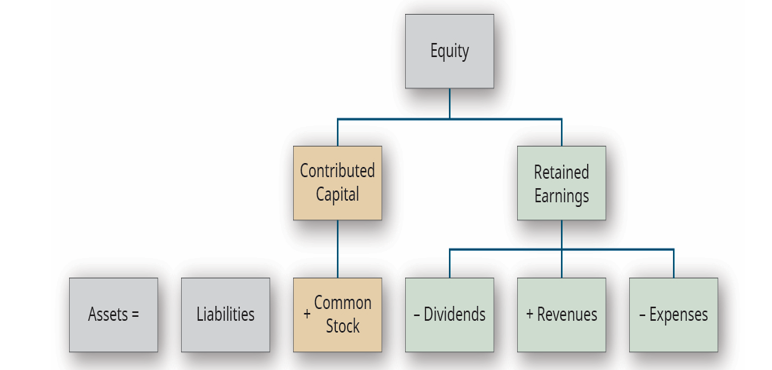

It follows the accounting equation

Asset= Liabilities+ Stockholders’ equity

This equation forms the fundamental model for business valuation too. This statement is critical for business owners, lenders, and creditors. If one understands how to read it, one can decipher the company’s position in the market. To tally a balance sheet one needs to tally and balance this equation.

Components of a Balance Sheet:

Assets:

Assets in business are quite similar, they are divided into 3 subheads:

- Fixed Assets/long-term assets

- Current assets.

- Other Assets

Fixed Assets are long-term in nature and cannot be converted into cash quickly. They could be furniture and fixtures, building & Property, machinery, etc. These assets are also depreciated over time.

Current Assets are those that can be quickly converted into cash. Hence bank balance, cash in hand, accounts receivables, inventory, etc are current assets.

Assets can be further classified as:

- Tangible

- Intangible

Something that can be touched is tangible, while something that can’t be touched is intangible. In accounts, Goodwill is a long-term asset and is intangible in nature. It is generally shown on the assets side when a company makes any merger or acquisition. Hence it is more like an advantage to the business’s reputation.

Liabilities:

Liabilities are something that the business owes. It can be called a burden or a debt as it needs to be paid off. For example, to run my business I would need a loan from the bank, when a bank gives me a loan, the bank expects me to return the loan over a period of time with interest. It is a liability till the time it is fully paid back.

Liabilities are further divided into 3 parts:

- Current Liability

- Long-term liability

- Other Liabilities

Current liability means the amount that needs to be paid within 1 year’s time while others that are to be paid after a year are classified as a long-term liability.

Examples of current liability include accounts payable, interest payable, income tax payable, etc. Examples of long-term liabilities include long-term loans (more than a year), bonds payable, deferred revenue, etc. Other liabilities include intercompany transactions such as borrowings.

Stockholders’ Equity (SE):

Stockholders’ equity means owners’ money. This statement shows changes in the stockholders’ equity over a period of time. Stockholders’ equity is divided into two parts contributed capital and retained earnings.

Contributed capital forms part of equity, it is generally contributed by the owner or the founder and it is also called Common stock.

Retained earnings are the amount of net income earned over the course of the company’s existence that was not distributed as dividends. (Think piggy bank, a small portion of your pocket money would go in this). Similarly from net income after dividend distribution, the portion that is left is retained in the business.

Facebook Example

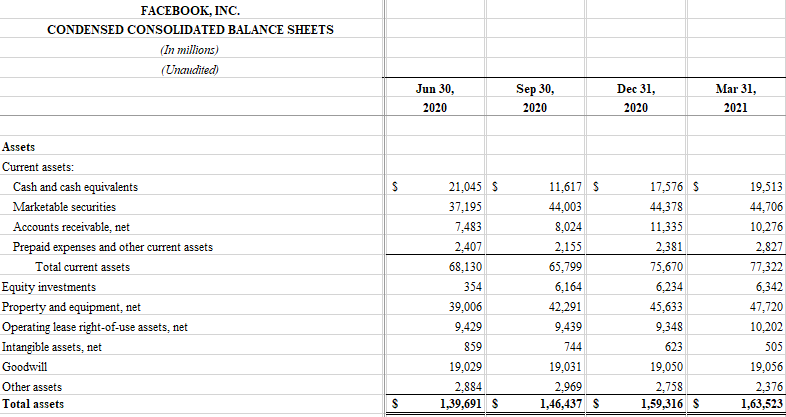

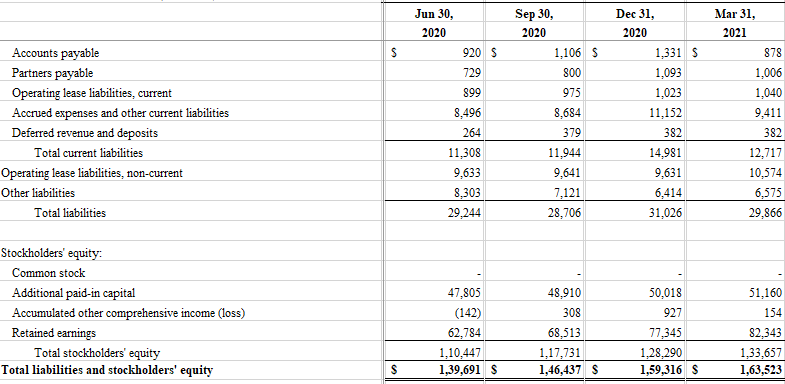

Below is a balance sheet of Facebook:

Total Liabilities stand at $ 29,866 for March’21 and total shareholding is $ 1,33,657. Reaching a total of $ 1,63, 523. As you can see, the balance sheet is tallied as the accounting equation balances. For March 31, 2021, both sides balance equally with 1,63, 523.

[…] there are some hidden assets in the organizations that are undervalued on the company’s balance sheet. A hidden asset is whose value is not shown in the balance sheet. A hidden asset can sometimes […]

[…] Balance sheet specifically doesn’t list out the profit, balance sheet is a statement which lists down the assets, liabilities and stockholders’ equity of a company for a particular period. Balance sheet is a good indicator of whether the company is financially stable or not. It helps owners and lenders to understand whether the company is just surviving or expanding. […]

[…] of Cash leads to increase in cash and cash equivalents in the balance sheet. Cash and cash equivalents on the balance sheet is comprised of Cash in hand and in bank+ Marketable […]

[…] starts with scrutinizing the profit and loss account and then inspecting the balance sheet. Balance sheet is based on the accounting […]

[…] When the order is received from the vendor, contents of the purchase order is compared with the invoice provided by the seller. This purchase amount is added and recorded in the books. This would show in the accounts payable (till the amount isn’t paid) under the liabilities in the balance sheet. […]

[…] materials in accounting are a part of inventory. In the balance sheet of the company, it is shown under the heading of current assets. Three parts of the inventory […]

[…] 3 year’s Income tax returns are checked along with last three years’ balance sheet, P&L’s and cash flows. Checking for the stability of company is important. Deeply […]

[…] in accounting is classified as a long term asset on the balance sheet. It is considered as fixed in nature. Unlike other assets, land is not depreciated in the books of […]

[…] Balance Sheet […]

[…] Aging is the process of becoming older with time. This is a natural biological process. Aging in accounts is similar too. Accounts receivables is a term used in accounts that are reported as current assets on the balance sheet. […]

[…] classified as an asset for the bank. All these loans are grouped together on the asset side of the balance sheet as personal loans, vehicle loans, student loans, etc. Now, when an individual/company defaults on […]