Movie Case Study

The scene you just saw from the movie ‘Yes man’ shows how Carl who is a bank loan officer has given out 561 loans in just 2 months. Although the amount of these loans is very small. These are called micro-loans, the purpose of these loans is for fulfilling smaller needs. This blog, Learning Perspectives will explore the meaning of microfinance loans.

What are Microfinance Loans?

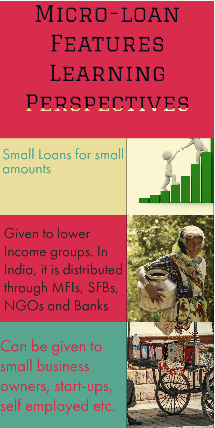

In India, microfinance loans are generally given to lower-income groups. Micro-finance loans are given by Microfinance institutions (MFIs), NGOs, SHGs (Self-help groups) banks, and small finance banks. they operate in the deepest districts of India to cater to the needs of the lower-income segment.

Similar to what the boss tells Carl (Jim Carrey), the repayment rate is high and the bank is making a lot of money since more than average loans are given, the same is true for micro-finance loan providers in India.

The repayment rate is high as the majority of MFI clients are women. The interest rate offered by MFI starts from 17% and is repayable at a high frequency. these loans can be availed by self-employed, start-ups, small business owners, and individuals who have lower capital requirements.

Purpose of these Loans:

As mentioned before, these loans are given to women entrepreneurs to purchase a small shop, cattle, buffalo, or an auto rickshaw. These loans are collateral free. Microfinance institutions (MFIs) are one of the fastest-growing segments in recent years in reaching out to small borrowers.

Modes of Micro-finance loans:

JLG or the joint liability group and SHG or the Self-help groups are models of financial inclusion for the poor.

The SHG-Bank Linkage Model was pioneered by NABARD in 1992. Under this model, women in a village are encouraged to form a Self-help Group (SHG) and members of the Group regularly contribute small savings to the Group. These savings which form an ever-growing nucleus are lent by the group to members and are later supplemented by loans provided by banks for income-generating activities and other purposes for sustainable livelihood promotion.

Under the NBFC model, NBFCs encourage villagers to form Joint Liability Groups (JLG) and give loans to the individual members of the JLG. The individual loans are jointly and severally guaranteed by the other members of the Group. Many of the NBFCs operating this model started off as non-profit entities providing micro-credit and other services to the poor. However, as they found themselves unable to raise adequate resources for the rapid growth of the activity, they converted themselves into for-profit NBFCs.

Understand Micro-finance Loans with a Video

References:

https://learningcommittee.files.wordpress.com/2016/01/industry-knowledge-module-02-30-1-2016.pdf

https://www.rbi.org.in/Scripts/PublicationReportDetails.aspx?ID=608#L2