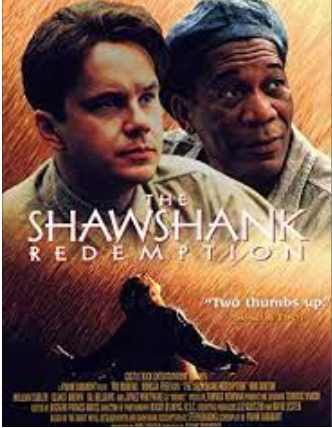

Case breakdown: Movie Shawshank Redemption

The scene that you saw shows how Captain Hadley is talking to his fellow colleagues and telling them about his inheritance of $35,000. Captain Hadley thinks the government will take $35,000 in the form of taxes. Andy, interjects the conversation by saying ‘do you trust your wife’?

and says to Captain that “If you want to keep that money, all of it, just give it to your wife. See, the IRS allows you a one-time-only gift to your spouse for up to $60,000, Tax-free. IRS can’t touch one cent.”

This scene from Shawshank Redemption is set up in 1949. What Captain Hadley doesn’t realize is that his inheritance is totally tax-free. It won’t be taxable income, and he gets to keep every nickel. Andy does not have to file any form or gift tax does not come into question. And, suddenly the movie gains more respect. Andy’s character is a banker by profession and does taxes, it is quite possible he is aware of the rule.

This blog, Learning Perspectives will explore the meaning of tax-free gifts.

What is a tax-free gift?

Gifts are given and received across the globe. If the gift given is of a very high value, it might be subject to tax. Tax treatment differs according to different countries. For example, In India gifts above Rs. 50,000 are taxable in nature. While in the United States, any gift above the value of $15,000 is chargeable to tax. Gift tax is paid by the giver of the gift, only if the gift is precious.

The gift tax is progressive, which means the rate increases as the size of the gift grows. The first dollar that is subject to the gift tax is taxed at a rate of 18%. While you can give up to $15,000 to anyone without incurring a gift tax, you can give even more—up to $157,000 in the tax year 2020—to your non-citizen spouse without incurring a gift tax.

According to the Internal Revenue Service (IRS), Any transfer to an individual, either directly or indirectly, where full consideration (measured in money or money’s worth) is not received in return is referred to as a gift.

Exceptions

The general rule is that any gift is a taxable gift. However, there are many exceptions to this rule. Generally, the following gifts are not taxable gifts.

- Gifts that are not more than the annual exclusion for the calendar year.

- Tuition or medical expenses you pay for someone (the educational and medical exclusions).

- Gifts to your spouse.

- Gifts to a political organization for its use.

References:

[…] exceeds Rs. 50,000 a year; then the amount is taxed in the hands of the receiver, but wait; if this gift is given by your relative then you can breathe a sigh of relief as it won’t be taxable. Vicky […]