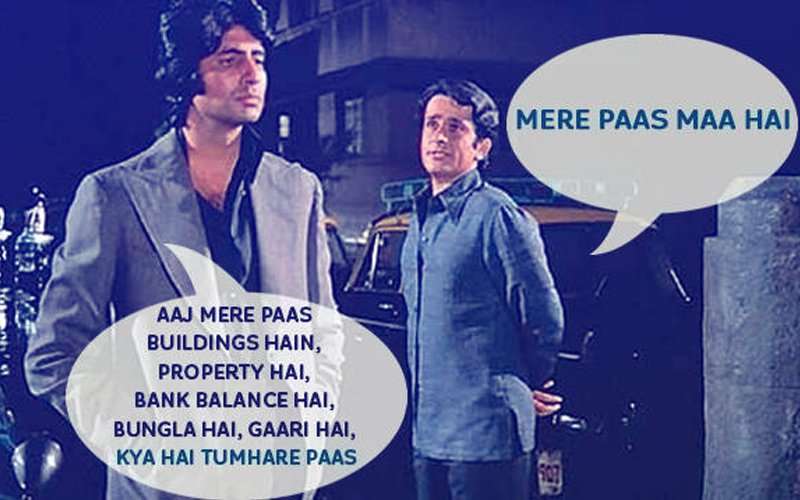

Case breakdown: Movie Deewar

Ravi and Vijay are brothers. If you watch this scene carefully Ravi (in a shirt is the Police officer) and Vijay- (played by Amitabh Bachchan) (thief) are having a conversation regarding their assets.

What you need to understand is that Vijay defines Ravi’s assets as the following:

- Rs. 500 salary job,

- A hired quarter,

- A jeep and

- 2 pairs of police’s (Khaki) uniform.

(Well, that’s not so nice according to Vijay). While the assets that Vijay has and boasts about are the following:

- Car (Gadi in hindi),

- Building

- Property and

- Bank balance.

What are Assets?

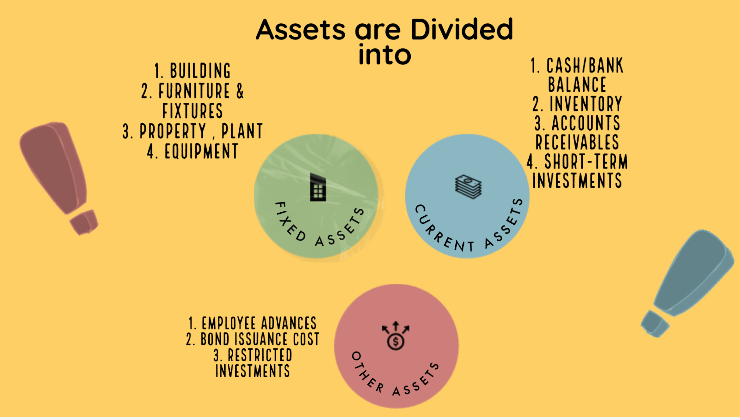

Assets in business are quite similar. Assets are resources owned by a business. These resources earn money for the business in the future. Assets are divided into 3 sub heads:

- Current assets

- Fixed Assets/long- term assets

- Other assets

Current Assets are those that can be quickly converted into cash. They are short-term in nature. Hence bank balance (as AB mentions), cash in hand, accounts receivables etc are current assets.

Fixed Assets or non-current assets are long term in nature and cannot be converted into cash quickly. They could be furniture and fixtures, building & Property, machinery etc. [like AB mentions- Bangla (Penthouse), Gadi (Car)].

Assets can further be classified as:

- Tangible

- Intangible

Something that can be touched is tangible, while something that can’t be touched but is felt is intangible.

‘Mere pass Maa (Mother) hain’ [I have a mother] dialogue used by Ravi sounds more like goodwill. In accounts, Goodwill is a long term asset and is intangible in nature. It is generally shown on the assets side when the company makes any merger or acquisition. Hence it is more like an advantage to the business’s reputation.

Besides goodwill, there are other intangibles’ in business such as trademarks, copyrights, patents etc. SK uses ‘Maa’ as Goodwill. Though mother isn’t intangible, but ‘love of a mother’ (MAA ka Pyaar) is and that’s why this scene is so legendary.

P.S: One also needs to understand that the principles (Oosol and Aadarsh) that Ravi and AB are talking about are actually accounting principles ( GAAP and IFRS). It is amusing how comfortably these two men are talking about accounts.

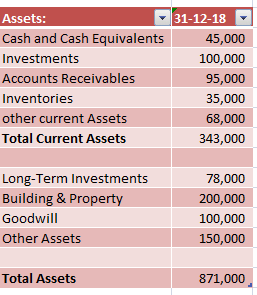

Below is an example of assets in a business:

[…] Assets: […]

[…] are many principles of accounting that can be misused while hiding an asset such as historic cost principle, revenue recognition and accrual concept as […]

[…] Next step includes computing cash generated from operating activities. Here changes in working capital are calculated, which means change in current assets and current liabilities. […]

[…] worth of a company is measured by subtracting liabilities from the assets. Assets are resources owned by the company while Liabilities or debt that the company owes. Hence, […]

[…] a part of the inventory. In the balance sheet of the company, it is reported under the heading of current assets. Three parts of the inventory […]

[…] deals with apportioning money or assets with the expectation of earning a return. While making an investment, the concept of risk and […]

[…] consultant who advises clients. This advice is generally related to where to invest their money and assets. Investment advisors generally form long-term relationships with their clients. As many of their […]

[…] to the scene that you saw, asset allocation deals with the division of money in different baskets. Asset allocation is used as an […]

[…] in accounts is similar too. Accounts receivables is a term used in accounts that are reported as current assets on the balance […]

[…] banks give out loans to customers, they are classified as an asset for the bank. All these loans are grouped together on the asset side of the balance sheet as […]

[…] Rent A/c is an asset A/c because for the company rent has been paid for 12 months, there would be an adjusting entry in […]

[…] doesn’t list out the profit, the balance sheet is a statement that lists down the assets, liabilities, and stockholders’ equity of a company for a particular period. The balance […]