Movie Case Study

The scene that you saw shows Raees (played by Shah Rukh Khan) talking to an older gentleman. He mentions a building that needs to be constructed on land for which he has given his word. Raees goes on to say, accounting (hisaab) has its own rule but here my rule exists.

In this blog, Learning Perspectives will explore the meaning of the rules of accounting.

What are the Rules of Accounting?

External transactions have the effect of increasing or decreasing the account balances. In accountancy words, increase and decrease are replaced with debit and credit. Now a student needs to understand how to increase and decrease account balances.

What is Debit & Credit?

Debit comes from the Latin word ‘debere’ which implies ‘to owe’ in English while Credit according to the English dictionary means to give praise, approval, honor, or something positive. In accountancy, they are quite close to their English meanings. As with learning any language, there are some rules that one needs to remember and apply, the same goes for accountancy.

Accounting Equation

Assets= Liabilities+ Stockholder’s Equity.

This is the accounting equation. This equation always balances out as this equation means the assets or resources of a business are equal to the claims of the creditors and owners of the business.

Double entry bookkeeping

One of the rules of accountancy is that every debit has a credit, hence it is also called double-entry book-keeping. This also means that two accounts will be affected in every transaction. e.g. Let’s say you received Rs. 5,000 in your account, your account balance increases (credits) by Rs. 5,000 but someone else’s account decreases (debit) by Rs. 5,000. Hence, just like every increase has a decrease every debit has a credit.

Formula

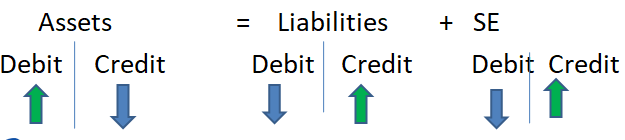

Whenever an asset increases we debit the account and when it decreases we credit the account. This situation reverses in the case of liabilities and stockholders’ equity.

If this rule is presented graphically, it will look like this:

Follow this rule to make journal Entries

Real-Life Examples:

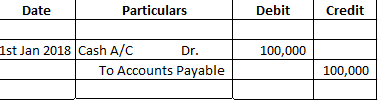

- If you borrow money from the bank, what will be the journal entry in the business:

The first thing to understand is when I borrow from a bank Rs. 1,00,000 and sign a note for it, I get Rs. one lakh which means Cash (Asset) comes into the business. This increases the assets of the business.

As there are no free lunches, Rs. one Lakh is not free as well, the bank gives me this as a loan (burden/liability), so it’s my obligation to pay back Rs. one Lakhs with interest to the bank. This increases the liability of my business by Rs. 1,00,000.

Now, according to rule 3, whenever an asset (cash) increases we debit it, so cash is debited, and if liabilities increase we credit it (See rule 3 above). Also, the equation would always be balanced. Hence, the journal entry becomes:

Being Rs. 1,00,000 borrowed from the bank

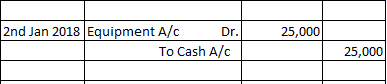

- If you purchase equipment for your business for Rs. 25,000

Let’s say I run a restaurant business, I would purchase a food processor or a bulk Roti maker, etc. to run my business. This would be an asset for my business. When I purchase it, this food processor would come into the business but another asset would go out and that would be cash.

So, if you see the rule an increase in assets, would be debited while a decrease in assets would be credited.

[…] recorded, when they are incurred. Expenses are debited in the income statement.This comes from the rule of journal entry that says: debit all expenses and credit all […]

[…] later. It is recorded in the books under accounts receivables. When cash comes in after two months journal entry recorded earlier changes and cash is […]

[…] understand how the journal entries for rent […]