Movie Case Study

Peter Parker is a photographer for Daily Bugle, an NYC tabloid newspaper. As Peter enters in the room, his boss shouts at him and fires him. At the very next moment, re-hires him as there are no photographers available and he wants some fresh photos. In return, Peter asks him for advance payment.

This blog, Learning Perspectives will explore advance payments.

What are Advance Payments?

Advance payment, as the name suggests is a payment that is made prior to the completion of an assignment. Advance payments are taken by many sellers and producers to cover their risk of non-payment by the client.

An example can include, wedding planners, caterers, and prepaid electricity providers. These are some of the vendors who ask for advance payments. The balance money is paid to them after the completion of the job.

How is Advance Payment Recorded?

In businesses, it is quite normal to receive and give payments in advance. A business owner can pay rent and insurance in advance and can receive money from clients in advance.

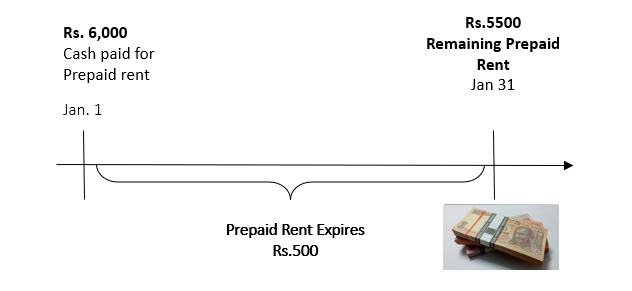

Let’s assume ABC business pays 1 year’s rent in advance on 1st January of Rs. 6,000 (500*12), now in ABC’s books on 1st January the entry would be

Prepaid Rent A/c Dr. 6,000

To Rent A/c 6,000

Prepaid Rent A/c is an asset A/c because for the company rent has been paid for 12 months, there would be an adjusting entry in this because the benefit from using the rented space occurs evenly over time, with 1 month’s cost attributable to January, February, March and so on.

Therefore, we need to record one month of the asset’s cost as an expense in January and include it in one month’s income statement, along with the revenue it helped to produce.

When closing the month of January, the entry would be:

Rent Expenses A/c Dr. 500

To Prepaid Rent 500

Now let’s assume the boss give Peter Parker the advance payment he asked for, how would Daily bugle record it in its books?

Advance Salary A/c Dr. 5,000

To Cash 5,000

Let’s say the company incurs $30,000 in total by the end of the month. Now the adjusting entry would be:

Salary Expense A/c Dr. 30,000

To Advance Salary 5,000

To Cash 25,000

Total salary expenses are $30,000 but the cash outflow would be $25,000 because $5,000 has already been paid to Peter Parker.

[…] This is true, even when the situation is reversed. That is, when the organizations receive rent in advance for their property. They record it as a prepaid […]