Movie Case Study

The scene shows Inspector Mane (played by Suniel Shetty) complaining about his salary. He says his salary is equivalent to TDS which is deducted from other people’s salaries.

In this blog, Learning Perspectives will explore the meaning of TDS.

What is TDS?

The full form of TDS is tax deducted at the source. It came into existence to deduct tax from the source of income. Tax is deducted on taxable income, hence individuals who earn an income are liable to pay TDS.

A popular term in the corporate sector is ‘salary in hand’. Professionals generally calculate the amount of salary that they would receive while taking a new job. This is because the salary that would reach their bank accounts would be after-tax.

This type of tax deduction helps in reducing tax evasion. TDS is not just applicable to salary but also to other instruments. These include:

- Payment of Rents

- Bank interests

- Interest from securities

- Amount in life insurance corporation

- Commission on insurance

- On acquisition of immovable property

- Transfer of immovable property

- Commission payments

- Payments of Contractors

Understand TDS with a Video

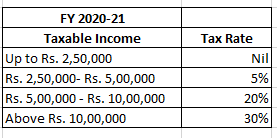

What are TDS rates?

TDS rates for a salaried employee range between 10% to 30%.

Income earned through the winning of lotteries/ card games/ horse races is charged at 30%. Payment towards national saving schemes attracts a TDS of 10%.

Payments towards the repurchase of units by UTI or mutual funds have a TDS rate of 20%. This TDS chart gives all the percentage rate of tax that is deducted by the government.