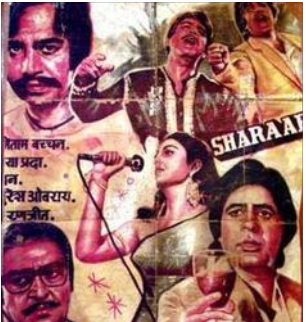

Case breakdown: Movie Sharaabi

Amitabh Bachchan (Vicky Kapoor) gifted Jaya Parda, his love interest, Rs. 9 lakh necklace. Even though she wanted to return the necklace as it was very expensive. The necklace was stolen before she could do that.

Seeing her upset, Vicky Kapoor lies to her and says that the necklace was a fake. He tries to convince her by saying, if he would have gifted her such an expensive necklace, he would have to pay tax on that.

What is Gift Tax?

If the value of the tohfa (gift) exceeds Rs. 50,000, it is taxable, but wait; if this gift is given by your relative then you can breathe a sigh of relief as it won’t be taxable. Vicky Kapoor (Amitabh Bachchan) is right and he would be taxed as the amount of jewellery gifted exceeds Rs. 50,000.

You might think even your bua’s dadi’s son’s daughter is your relative. Don’t worry too much about who’s your relative. The income tax department clearly defines who your relatives are.

A relative according to section 2(41) of Income-tax is as follows:

- Husband or wife i.e. Spouse of the individual

- Brother or sister of the individual

- Brother or sister of the spouse of the individual

- Brother or sister of either of the parents of the individual

- Any lineal ascendant or descendant of the individual

- Any lineal ascendant or descendant of the spouse of the individual

Any sum of money or property received is not taxable on the occasion of the marriage of an individual (I wonder what it promotes).

Also, any sum of money or property that is received under a will or by way of inheritance is also exempt from tax. The amount received from a local authority, fund, foundation, or educational institution too shall not be taxable.

[…] it might be subject to tax. Tax treatment differs according to different countries. For example, In India gifts above Rs. 50,000 are taxable in nature. While in United States, any gift above the value of […]