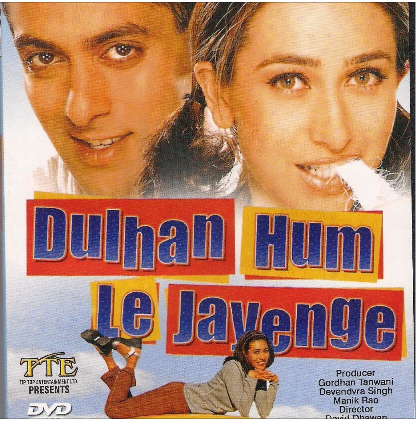

Movie Case Study

The scene that you just saw shows Satish Kaushik who is trying to nab Mr. Oberoi (played by Kader Khan). He is actually an Income tax officer. Mr. Oberoi claims that he submits income tax regularly and there is no lapse in the company.

In this blog, Learning Perspectives will explore what exactly is Income Tax.

What is Income Tax?

An income tax is a tax that is imposed by the government on the income that is earned by an individual or a business in a particular period. Taxpayers file a tax return or the income tax return (ITR). It is a prescribed form that communicates an individual/business’s tax obligation.

Income taxes are revenues for the government, which the government, in turn, uses to fund public services, construct roads and flyovers and pay other obligations of the government.

How Does Income Tax Work?

Income tax is to be paid by every person. The term ‘person’ as defined under the Income-tax Act under section 2(3) covers in its ambit natural as well as artificial persons.

‘Person’ includes individuals, HUF or Hindu Undivided Family, AOP or Association of Persons, Body of individuals [BOIs], Firms, LLPs, Companies, Local authority, and any artificial juridical person not covered under any of the above.

Tax Laws

The income tax department in India collects taxes in India and sets and enforces laws regarding the same. There are three ways through which government collects taxes:

- Voluntary payment by taxpayers into various designated Banks. For example, Advance Tax and Self Assessment Tax are paid by the taxpayers.

- Taxes deducted at source [TDS] from the income of the receiver,

- Taxes collected at source [TCS].

Income that is chargeable to tax is called taxable income while income that is exempt from tax is called exempt income. Individuals who need to file an income tax return (ITR-1) 1, are salaried employees. ITR 5 can be used by a person being a firm, LLP, AOP, BOI, or artificial juridical person.

How can the returns be furnished?

The Return Form can be filed with the Income-tax Department in any of the following ways, –

(i) by furnishing the return in a paper form;

(ii) by furnishing the return electronically under a digital signature;

(iii) by transmitting the data in the return electronically under an electronic verification code;

(iv) by transmitting the data in the return electronically and thereafter submitting the verification of the return in Return.

References: https://incometaxindia.gov.in/Pages/faqs.aspx?k=FAQs%20on%20filing%20the%20return%20of%20income

[…] that reports a net loss does not pay tax on it. This happens because the company isn’t earning any income in that particular period. […]

[…] TDS is tax deducted at the source. It came into existence to deduct tax from the source of income. Tax is deducted on taxable income, hence individuals who earn an income are liable to pay […]

[…] to section 132 of the Income Tax Act, these raids can be conducted […]

[…] son’s daughter is your relative. Don’t worry too much about who’s your relative. The income tax department clearly defines who your relatives […]