Movie Case Study

The scene that you just saw shows how a salesman is being asked by the owner to stay after work to figure out the stock left for Banarsi Sarees in the inventory. The owner wants to understand the stock of Benarsi Sarees to place an order with the supplier.

This blog, Learning Perspectives explores what is Inventory and how is it valued.

What is Stock or Inventory?

Inventory can be defined as items that are intended to be sold to customers. In the above scene, inventory is the variety of Sarees that the shop sells, such as Banarsi, Kanjeevaram, Bandhani, etc. (names of the sarees)

Companies can either be merchandising or manufacturing companies. Merchandising companies include companies such as Amazon, Flipkart, etc. These companies don’t produce their own products but buy from a wholesaler and sell it to customers. Inventory for these companies includes all kinds of goods such as sunglasses, laptops, groceries, etc.

The manufacturing company, on the other hand, sell the finished good that they produce rather than buying from a supplier in a finished form such as cars, shampoos, oils, biscuits, etc. Examples can include Dabur, Marico, Apple, Coca-Cola, Mercedes, etc.

Inventory can also include items that are not finished goods yet. Such as rubber at a tire manufacturer.

How is Inventory Reported?

Inventory is reported as current assets on the balance sheet. It is an asset because it represents a valuable resource that the company owns. It is reported as current because the company intends to convert it into cash soon by selling it.

The formula for Calculating the beginning Inventory is:

Beginning Inventory= COGS+ Closing Inventory- Purchases

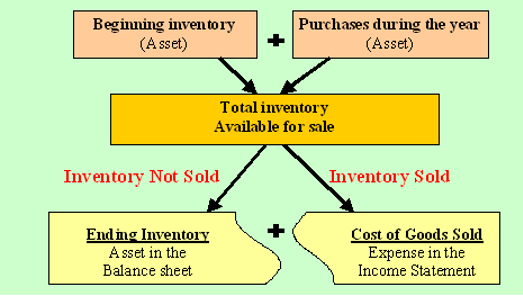

Inventory represents the cost of inventory not sold, while the cost of goods sold represents the cost of inventory sold. The costs of beginning inventory plus additional purchases make up the cost of goods (or inventory) available for sale.

For a manufacturing company, inventory is classified into 3 categories

1. Raw material

2. Work in progress

3. Finished Goods

Inventory Valuation:

Inventory is valued on the basis of 3 methods:

• FIFO

• LIFO

• WEIGHTED-AVERAGE

FIFO/ First in first out:

It is assumed the first units purchased will be sold first. it also assumes that the beginning inventory sells first, followed by the inventory from the first purchase during the year, and so on.

LIFO/ Last in Last Out:

It is assumed that the last units purchased are the first ones sold.

Weighted Average cost:

Here the assumption is that the both cost of goods sold and ending inventory consist of a random mixture of all goods available for sale.

Weighted Average Unit Cost= Cost of goods available for Sale/No. Of units available for sale.

Example:

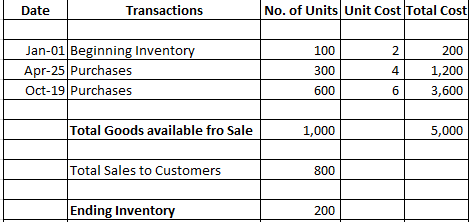

Let’s understand this with an example, Saree shop has 100 units of inventory at the beginning of the year and then makes two purchases during the year—one on April 25 and one on October 19.

There are 1,000 Sarees available for sale. During the year, it sells 800 Sarees for Rs. 10 each. This means that 200 Sarees remain in the ending inventory at the end of the year.

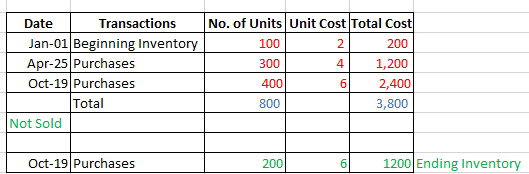

Under the FIFO system of valuation, it would mean, selling those sarees first that were purchased first. When 800 sarees are sold, the Valuation under FIFO would look like this:

The total goods available for sale are 1000, from the beginning inventory 100 would be sold for Rs. 2 unit cost, similarly, for the ones purchased on Apr-25, 300 units will be sold for Rs. 4. Till now, a total of 400 units are sold. If there is a sale of 800 units, only 400 units would be sold out of the purchases made on Oct 25 (i.e. 600). So the Sale chart would be the one in red. The total cost in effect would be Rs. 3,800 which is the cost of goods sold. 200 units will be placed at 6 per unit (it was purchased at the same price). Hence the ending inventory would be Rs. 1,200.

[…] materials in accounting are a part of inventory. In the balance sheet of the company, it is shown under the heading of current assets. Three parts […]

[…] To sell its inventory. […]

[…] 1. A common cause is less sales or revenue in the company. This occurs due to ineffective marketing campaign, strong competition, unsuccessful pricing strategy, poor advertising , unresponsive customer service. There can be many reasons because of which company may not be able to drive sales. Hence an efficient strategy should be in place to drive revenue. 2. Another cause could be higher costs. This is especially true for a manufacturing company where the company incurs higher costs of goods sols (COGS). […]

[…] Inventory is an important aspect that should be looked into. Re-order level should be defined. Also, to maintain proper inventory levels, systems of FIFO or LIFO or weighted average cost should be used. This helps the production manager to ensure smooth functioning of inventory. Inventories are critical for the success of a production manager. […]

[…] distribution network is the interconnected facility of transport and warehouses to enable the inventory of goods to be stored and delivered to the customer. This includes logistic hubs, transfer points, […]