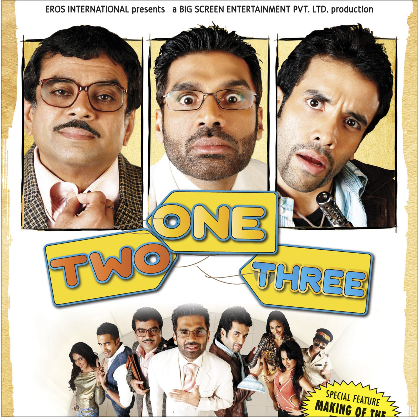

Movie Case Study

The scene that you saw shows Laila (played by Sameera Reddy) who had taken a loan of Rs. 25 Lakhs for her showroom. She is being served a notice from the bank ICUC regarding her unpaid installments for the last 10 months. The bank would take all her cars from the showroom if she isn’t able to pay her installments.

What are Bad-debts?

Bad debts are expenses for the banks or any other lender. Bad debts occur when an individual/business is not able to fulfill its obligation to pay back the loan or credit that was granted to them.

When a bank grants credit to anyone, there is always a risk of default. Hence, companies maintain a reserve known as a provision for doubtful debts. If the loan is noncollectable, it is written off from the books.

When banks give out loans to customers, they are classified as an asset for the bank. All these loans are grouped together on the asset side of the balance sheet as personal loans, vehicle loans, student loans, etc. Now, when an individual/company defaults on the payment of the loan then after 90 days of non-payment of the loan, that bad debt becomes an NPA or nonperforming asset.

According to RBI, the system should ensure that the identification of NPAs is done on an ongoing basis. Banks should also make provisions for NPAs at the end of each calendar quarter i.e. at the end of March / June / September / December.

Classification of Assets

Banks should classify their assets into the following broad groups, viz. –

(i) Standard Assets

(ii) Sub-standard Assets

(iii) Doubtful Assets

(iv) Loss Assets

Standard Asset:

This asset does not disclose any problems and does not carry more than normal risk attached to the business. Such an asset should not be an NPA.

Sub-Standard Asset:

An asset would be classified as a sub-standard asset, if it has remained an NPA for a period less than or equal to 12 months. An asset where the terms of the loan agreement regarding interest and principal have been re-negotiated or rescheduled after commencement of production should be classified as sub-standard.

Doubtful Assets:

A loan classified as doubtful has all the weaknesses inherent in the sub-standard asset, along with the weaknesses in collection or liquidation in full, on the basis of currently known facts which are conditions and values that are highly questionable and improbable.

Loss Assets:

An asset is considered a loss asset when it is non-collectible. It is of little value that its continuance as a bankable asset is not warranted although there may be some salvage or recovery value.

COVID and Bad-debts:

During the COVID crisis, RBI has forecasted that the NPA’s will rise in 2021 by 13.5% from 7.5% last year. RBI took some steps regarding the moratorium that ended in August 2020, followed by a two-year debt restructuring program. The RBI expects banks’ capital ratios will erode to 14% in September 2021 from 15.6% in September 2020.

Understand Bad Debts with a Video

References:

https://www.rbi.org.in/commonperson/English/Scripts/Notification.aspx?Id=889