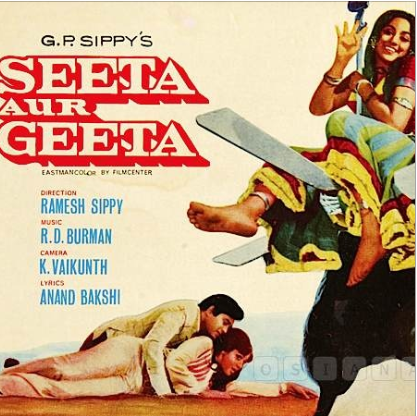

Movie Case Study

The scene that you saw shows how Geeta pretending to be Seeta (played by Hema Malini) is being given her monthly share of cash by the accountant. Seeta, later hands over this cash to her aunt (Chachi), who actually wants to steal her money.

Similarly, In businesses cash flows in and out of business. In this blog, Learning Perspectives explores what activities make cash flow in and out of the business.

What are Cash flows in Business?

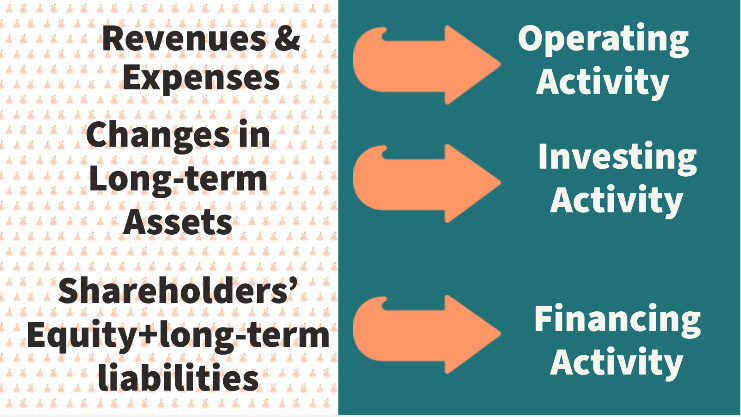

In any business, there is both inflow and outflow of cash. Cash comes and goes out of the business mainly through three business activities. These activities are:

- Operating Activities

- Investing Activities

- Financing Activities

Inflows of Cash lead to an increase in cash and cash equivalents on the balance sheet. Cash and cash equivalents on the balance sheet are comprised of Cash in hand and in bank+ Marketable securities+ Short-term Investments.

Cash inflows take place in a business when cash Sales occur or when cash is received from people who owe the business money (receivables) or if there is a sale of a fixed asset.

Outflows of Cash lead to a decrease in cash and cash equivalents. These outflows of cash in a business can be through cash purchases made, cash paid for expenses, or cash used to purchase fixed assets.

All businesses prepare a cash flow statement to ascertain the exact net cash available with the company. This statement also helps in planning to operate, invest and finance requirements of the company. It helps in assessing liquidity and solvency which means figuring out whether the company would be able to meet its liabilities in the future or not.

A cash flow statement (CFS) also helps in variance study with the budget of the company and hence it helps management in the decision-making process.

Operating Activities:

As the name suggests, operating activities are those activities that relate to the main operations of the business. For example, the main activity of a restaurant is to cook and serve food, any income derived from the sale of the food is the operating income, and all activities undertaken to sell that food are operating activities. Money spent on buying vegetables, electricity spent while cooking and making that food, the salary of the cook, etc. all these form part of the operating activity.

If money comes into the business in the form of rental income, that will be termed as non-operating.

Investing Activities:

This includes investment in fixed assets or the sale of a fixed asset. In a restaurant, if I have to purchase a state-of-the-art oven and gas. These are fixed assets for the business, i.e. I will make a one-time purchase and it is bound to last for at least 5 years. Hence any purchase or sale I undertake in this regard will fall under investment activities. These activities also include payment for the purchase of securities and receipts, loans, and advances to third parties.

Financing Activities:

Financing activities are the activities that result in a change in the size of owners’ equity or capital. Cash flows from financing activities include proceeds from the issue of shares, proceeds from the issue of debentures, buy-back of equity shares, payment of interest on borrowings, etc.

Example- Apple Case

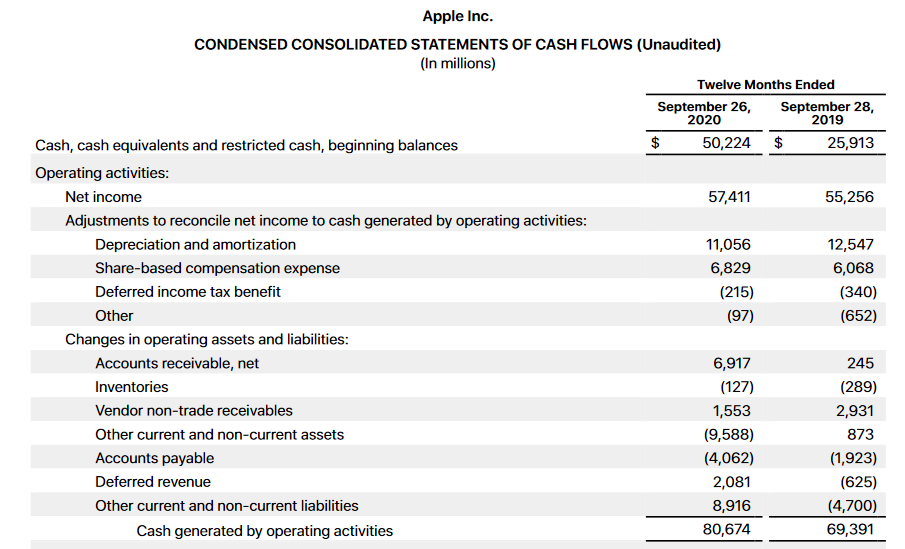

Below is Apple’s Cash flow statement from operating activities for September 2020 and 2019.

The first step in preparing a cash flow statement is to determine the net profit. All non-cash expenses are added back here. For e.g. deprecation and amortization. These are added back as these expenses do not involve any cash payments. Non-cash income is deducted from net profit as they do not involve a receipt of cash. One can see in Apple’s cash flow statement depreciation & amortization (expense) are added while deferred income tax benefit (income) is deducted for 2020 and 2019.

The next step includes computing cash generated from operating activities. Here changes in working capital are calculated, which means changes in current assets and current liabilities.

An increase in current assets and a decrease in current liabilities are deducted because they decrease cash flow from operating activities.

A decrease in current assets and an increase in current liabilities are added to operating profit since they result in an increase in cash flow from operating activities.

Income tax paid is deducted from Cash generated from operations to determine cash flow from operating activities.

[…] are recorded in the books of accounts in the income statement. Under the cash accounting system, expenses are recorded as soon as the expenses are paid. While under the accrual […]

[…] agreement between him and the shopkeeper that he needs to pay. Thereafter, he willingly pays the cash and he is given a receipt for the […]

[…] the raw material, processing it to make a finished product, selling it and converting into cash and cash […]

[…] tax returns are checked along with last three years’ balance sheet, P&L’s and cash flows. Checking for the stability of company is important. Deeply understanding the financials helps to […]

[…] The Cash flow Statement […]

[…] universally available. All the financial statements such as income statements, balance sheets, and cash flow statements are all presented in terms of […]

[…] looking at cash flow statements and statements of stockholders’ equity would make an investor understand the overall health of […]