Movie Case Study

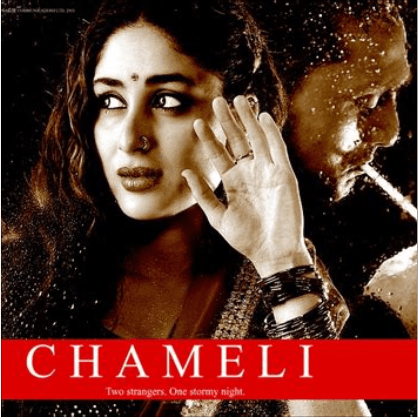

The scene above shows a conversation between Chameli (played by Kareena Kapoor) and Aman (played by Rahul Bose). Chameli is surprised to learn that Aman earns Rs. 10,000 per hour for giving investment advice. In this blog, Learning Perspectives will explore the meaning of an Investment consultant.

Who is an Investment Consultant?

An investment consultant is a consultant who advises clients. This advice is generally related to where to invest their money and assets. Investment advisors generally form long-term relationships with their clients. As many of their investments might also be long-term in nature.

Investment advisors help clients formulate their goals and advise on the best financial investments according to their current earnings and savings. An investment consultant’s educational background can include portfolio and asset management, financial engineering, and risk management.

As Chameli mentions in the scene, you must be highly qualified to charge Rs. 10,000 for an hour. Generally, investment advisors are qualified. They also have licenses to operate as an independent financial advisor. They advise clients on taxes, retirement planning, and various funds in which they can invest their money. Many investment advisors in India are CAs (Charted Accountants).

Types of Investment Consultants:

Personal Advisors

These advisors work at a bank or might be independent financial consultants. They understand the implications of investing money in various financial instruments. They deeply understand the customer by inquiring about their age, salary, and their risk appetite before suggesting any instrument for investments.

Insurance Advisors

These advisors are trained and given licenses to operate in the market. They give advice on various insurance products that the consumer can invest in. Some insurance agents and advisors train either in one area of insurance or a range of different insurances. (life, health, vehicle, etc.)

Financial Planner

This advisor chalks out a financial plan for the client. This would incorporate tax savings, financial investments, risk management, retirement planning, and investment planning.

Relationship Managers

These customer relationship managers are allotted by the bank to you. They help the client by advising them on the products issued by the bank. They also help the customer in solving any technical or business challenges.