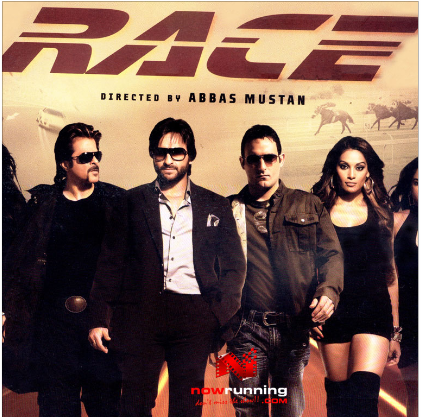

Movie Case Study

The scene that you just saw shows Rajiv Singh (played by Akshaye Khanna) is making a plan with Sonia (played by Bipasha Basu). He tells her that he and his brother has $ 50 million insurance policy each. He is making a plan to kill his brother so that he can receive double the amount under the indemnity clause.

In this blog, Learning Perspectives will explore the meaning of insurance policies.

What are Insurance Policies?

Insurance contracts are those contracts that enable individuals or entities to receive financial protection against insurance losses. This contract is between the policyholder (individual/entity who buys the policy) and the insurance company that provides the contract. In case of death/disaster or eventuality, the insurance company provides the money to the policyholder or the nominee.

Components of Insurance Policy:

Insurance Premiums:

Premiums are paid by the policyholder. It is the amount that allows an individual to buy insurance coverage. This is generally paid by the policyholder either monthly, quarterly, semi-annually, or annually. Different insurance policy providers ask for different premiums. A policyholder should research the policy and pay premiums accordingly.

Insurance policies can be for:

- Life

- Health

- Motor

- Home

Policy Limit:

It is the maximum amount that the insurance company pays for the losses under the insurance policy. This amount is calculated based on the following:

- Duration

- Injury

- Indemnity Clause, if any

As Rajiv mentions the indemnity clause. The indemnity clause policy protects individuals and business owners in case of an event. In this case, the death of Rajiv’s brother. Indemnity is a contractual agreement between two parties. In this agreement, one party decides to pay for any losses that another party causes. Risks are managed between the parties through indemnity clauses.

If the death of an individual occurs and the nominee is suspected to be involved, then a police case is registered. Generally, when there is death by murder, the following documents are required:

- Death Certificate

- FIR

- Postmortem report

The Claim amount is paid to the legal heir. In case there is no legal heir, the amount is kept in the court till a successor is found.

Deductible:

It is the amount paid by the policyholder before the insurance company pays the claim. This could be in the form of percentage or out-of-pocket expenses for the policyholder.

In India, people can avail of tax benefits by purchasing an insurance policy:

80C:

Premium paid towards a life insurance policy is eligible for deduction under section 80C. Premium should be paid for a life insurance policy either for self or dependents.

80D:

This deduction is applicable to medical or health insurance. It is allowed when the premium is paid on self’s health policy or for health care of family members including parents.

10D(D):

This benefit is provided towards the premium paid for the life insurance policy.

[…] cost. There are many benefits given to an employee in an organization. This ranges from medical insurance to special allowances. Government employees enjoy a wide variety of benefits, hence a government […]

[…] to build its cash flow and liquidity at the time of emergency. Contingency plans may also include insurance policies that help the company in unforeseen situations. Pandemic wasn’t covered in Insurance policies […]

[…] in life insurance […]

[…] it is quite normal to receive and give payments in advance. A business owner can pay rent and insurance in advance and can receive money from clients in […]