Case breakdown: Movie Back to School

The scene that you just saw shows how a professor is trying to take a class on cost analysis. He is continuously interrupted by an older student (Mr. Melon) who has rejoined college to show solidarity with his son. He is arguing with him about the costs that should be included in the case he is discussing. A professor is taken aback by his knowledge as he talks from a real-life perspective.

This blog, Learning Perspectives will explore the meaning of production cost.

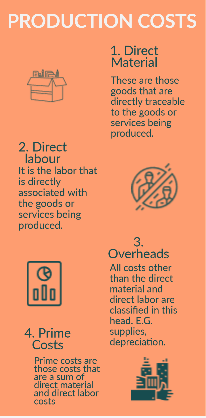

What is Production Cost?

Production Costs are those costs that are associated with the manufacture of goods. Nonproduction costs are those associated with designing, marketing, packaging, distribution, customer services, and general administration. For Tangible goods, production and non-production costs are often referred to as manufacturing costs and non-manufacturing costs respectively. Production costs can be further divided into:

- Direct Material

- Direct Labour

- Overheads

Direct Materials:

These are those goods that are directly traceable to the goods or services being produced. The costs of these materials can be directly charged to products because physical observation can be used to measure the quantity consumed by each product. For example steel in an automobile, denim in Jeans, alcohol in cologne, etc.

Direct Labour:

It is the labor that is directly associated with the goods or services being produced. Those employees who convert raw materials into finished products or who provide service to a customer are called direct labor. For example, a chef in a restaurant, workers on an assembly line, etc.

Overhead:

All costs other than the direct material and direct labor are classified in this head. Examples include supplies, depreciation, etc fall under this category. Supplies are generally materials necessary for production but are not included in the finished product. Oil is used for the production of equipment and will form part of supplies.

Prime Cost and Conversion Costs

Combinations of different production costs lead to the concept of conversion costs and prime costs. Prime costs are those costs that are a sum of direct material and direct labor costs while Conversion costs are the sum of direct labor costs and overhead costs. For a manufacturing company, conversion costs can be seen as the cost of converting raw material into a final product.

Selling and Administration Costs

Costs that are necessary to market and distribute the product are called Selling costs. These include salaries and commissions to sales employees. It also includes warehousing, shipping, etc.

Costs associated with research, development, and general administration fall under the category of administrative costs. Examples include legal fees, annual report printing costs, etc.

[…] Direct materials are those materials that are direct in nature, these materials are directly involved in the process of making finished goods. For example: flour in a cake, wood in a chair or wood in a chair. These are shown in the income statement under Cost of goods sold. […]

[…] also track costs of raw material, labor, and overhead costs which ensures smooth production. They deal with men, machines, materials, methods and money. Hence, […]

[…] the opposite of net profit. Profit in the business occurs when revenue or sales are higher than the costs […]

[…] Production costs are divided into: […]