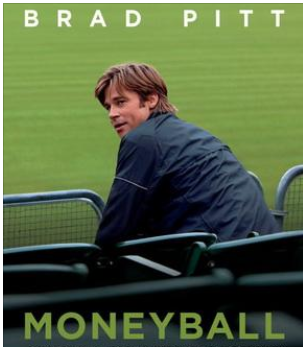

Case Breakdown: Movie Moneyball

This movie is based on the book “Moneyball: The Art of Winning an Unfair Game” by Michael Lewis. The scene is showing how players are being valued on the basis of statistics called the sabemetrics. Generally, a baseball player’s worth is measured by his track record of getting on base, regardless of how it was achieved (i.e. base hits vs. walks). A player who increased their on-base percentage by scoring lots of walks was systemically undervalued.

Billy Beane (played by Bradd Pitt) was able to buy players as cheaply as possible rather than buying players’ for their perceived growth. He was able to accomplish this because each player had a defect (e.g. appearance, age, awkward body mechanics, or injury) that posited him as being undesirable to most teams, despite sporting a strong track record.

What is Value Investing?

Value Investing means picking stocks that are trading at less than their intrinsic value. The intrinsic value of the stock is a ‘true’ value based on accurate risk and return data. It can be estimated but cannot be accurately measured.

Similar to the scene that we saw, value investing is buying the stock for the least amount of money. Investors should make wise choices when selecting stock just as Billy did. These investors pick out stocks that are undervalued and hope to gain from them in the future.

Stock prices can have an upward or downward movement even if the value of the business remains the same. This concept is understood by value investors. They invest in stocks that are not popular and are being brought by everyone, they do their own financial analysis and do not follow the herd mentality. Warren Buffet and Benjamin Graham are well-known value investors.

The Oakland A’s were able to acquire Chad Bradford, one of the most effective relief pitchers in Major League Baseball, for only $237,000. He was chronically undervalued in the eyes of scouts. In Investing too, companies that have perceived defects or some uncertainty can become undervalued.

Financial ratios help in understanding the over and undervaluation of stocks, such as:

Price to book ratio (P/B ratio)

Measures the company’s current market value to the book value (Value of assets). If the market price is lower than the book value, this would indicate that the stock is undervalued.

Price Earning Ratio (P/E ratio)

It measures the current market price and the earnings per share (EPS) of the company. It helps in understanding the undervaluation and overvaluation of stock. A high P/e could indicate that the company’s stock is overvalued.

[…] Analyzing which horse is undervalued, selecting the horse that provides higher odds will get you better value for your bet. This strategy is similar to value investing. […]

On price-to-book, consistently measured over only the 90% of non-super expensive stocks, today we re at almost the 1h percentile, the deviation over median is at 89% of the maximum deviation over median ever (again the maximum was at the end of the GFC), and if we switch from price-to-book to the composite of the four valuation measures, we re at round-to-the-1h percentile and all the way up to 96% of the maximum deviation over median.

We wouldn t want to remove the most expensive stocks from our value stock universe but again, the strategy is so diversified they really aren’t driving things, and critiques of value investing that depend on these extremes really have no leg to stand on.

Four Valuation measures that you mention would include:

Price to book, price to sales, price to earning (forecast and trailing).

It looks like some research statistics, will be happy to look into it.

Thanks, Learning Perspectives