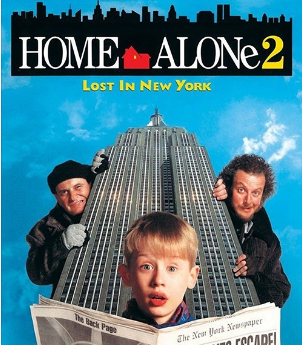

Movie Case Study

The scene that you saw shows how Kevin, a small boy is using his father’s credit card to book a hotel room and later presents the same on the hotel counter for payment. In this blog, Learning Perspectives explores what exactly is a credit card and how does it work?

What is a Credit card?

Credit cards are generally issued by banks and/or financial institutions. They are thin rectangular plastic cards (as you witnessed in the scene), they are lightweight, and can be carried around anywhere. They can be used to pay bills and make purchases anywhere in the country.

Banks also issue debit card which looks similar to credit card. The difference between a debit card and a credit card lies in its operation. A debit card uses funds that are present in your bank account. If you swipe your debit card at a shop, then the amount is immediately deducted from your bank account. While in the case of a credit card, one is given time to repay the amount owed.

How does a Credit card work?

Let’s say you shop for Rs. 50,000 at a mall on 5th January and you pay through your credit card, in this case, you will have to pay Rs. 50,000 on the due date of your bill cycle. The credit card billing cycle varies from 28-30 days depending on the issuer. At the end of the billing cycle, one needs to pay for the unbilled amount, fees, or charges for that period. The time between your purchase and the due date is called the grace period.

Credit cards are called debt instruments because they provide a grace period and provides time to pay off debt. A regular debit card is linked to your savings bank account.

Above is the format of a credit card, the right corner of the card has the bank name and logo. Right above the 16-digit card number is the microchip inserted into the card. A chip card is less prone to fraud. A chip card is inserted into the card to make it more secure. Mentioned below in the card is the Valid Thru part which indicates the expiration date of the card. Card holders’ name is also mentioned on the card.

Visa and Mastercard are the credit card networks that would feature on the bottom right of the card. They process credit card transactions. They act as an interface between banks/financial institutions and merchants (shops).

[…] loans, home loans, line of credit are all types of credit instruments. Credit card issued by the bank also allows a customer to purchase goods on credit and pay at a later date to […]

[…] loans doesn’t require any collateral. It’s based entirely on your good credit history. Most credit cards fall into this […]

[…] may also indicate the mode of payment undertook by the customer. Modes of payment may include debit or credit card, cheque, cash or digital wallet. This receipt also includes the invoice number. It may also include […]

[…] interest. Most common form of debt are loans which include home loans, auto loans, personal loans, credit card debt […]