Movie Case Study

The scene that you just saw shows how two bank employees are claiming that Sanjana’s father had taken a loan of Rs. 200 crores from the bank. And before repaying, he passed away. So, the bank officials are trying to recover the loan by seizing the property of Sanjana’s would-be husband.

What is Collateral?

Loans are of two types: Secured and Unsecured loans. Secured loans are those which require one to list something of value in order to guarantee the loan. Most standard types of mortgages and auto loans are considered secured credit because the loan holder can take possession of your house or car if you don’t pay as agreed.

Collateral means an asset that the lender (bank) accepts as a security of the loan. For example: When taking a loan of Rs. 5,00,000, an equal value of the asset is to be kept as a security with the bank, in case the customer defaults. The bank can sell the valuable collateral and recover the loan that it had granted the customer. Collateral helps minimize the risk for the lender and serves as a protection.

Unsecured Loans- These loans don’t require any collateral. It’s based entirely on your good credit history. Most credit cards fall into this category.

While in the movie, Sanjana is planning all this, to not get married to the man in the blue robe. Hence, bank officials seem to be faking. If Sanjana’s father had taken a loan of Rs. 200 crores from the bank. Bank would have already kept collateral before granting the loan i.e., properties or jewelry, or land would already be kept as a security with the bank. Bank officials wouldn’t have to look for property from Sanjana’s would-be husband.

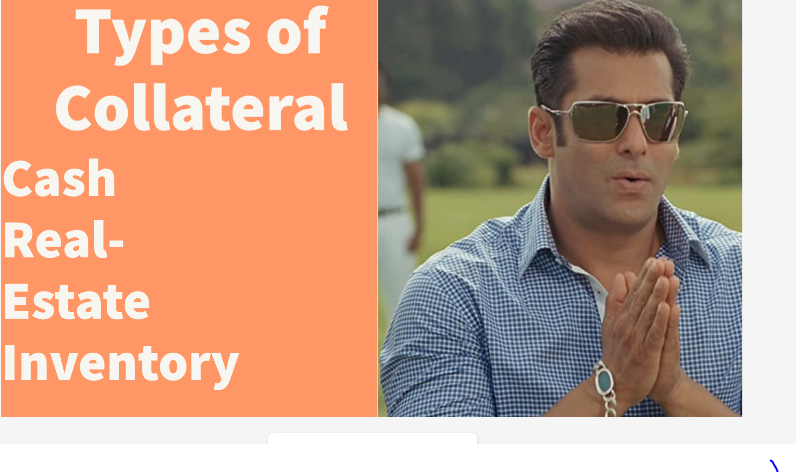

Types of Collateral:

Cash:

When an individual takes a loan from a bank of which he is already a customer. In case of default or death, the bank can seize his bank account to recover the loan amount.

Real Estate:

The most common type of collateral is real estate. Many people deposit their property papers are collateral. This includes houses or land or any other property. In case of default or death, the bank can recover the loan amount.

Inventory Financing:

This means inventory serves as collateral for a loan. In case of a default, items of the inventory can be sold by the bank to recover the loan amount.

[…] As indicated in the scene above, Kumar (Played by Rajnikant) says to Tiger (Amitabh Bachhan) that because of his past bad deeds (paapon ka Karz/Loan) that was drawn on his name and now he is responsible for the the payment along with the interest (Sood ke Saath). [As his family is taken as a Collateral] […]

[…] Secured loans […]