Movie Case Study

The scene that you saw shows a conversation between Raj Malhotra & Priya. Priya & Raj found a young kid who is lost. There is price money attached to the kid for Rs. 25 Lakhs. Priya wants to claim this prize money, however, Raj sees the ad in the paper and proclaims that this kid is a bearer cheque of Rs. 25 Lakhs.

Learning Perspectives will explore the meaning of a bearer cheque in this blog.

What is a Bearer Cheque?

Bearer Cheque is a cheque that makes the holder of the cheque eligible for payment. That means these cheques do not require any authentication of the account holder and the payment is made to someone who is carrying the cheque. The bearer cheque does not contain a name, hence whoever is holding the cheque receives the payment.

For this reason, Raj says that the kid is a bearer cheque as he is carrying the kid and the kid would guarantee payment of Rs. 25,00,000. Bearer cheques are beneficial until they get stolen. Hence, sometimes bearer cheques are not considered safe.

Understand Bearer Cheque with this Video

Features of a Bearer Cheque:

- A bearer cheque does not require an endorsement.

- A bearer cheque can be converted into an order cheque.

- The holder of the bearer cheque does not necessarily have to be the account holder.

- Bearer cheques ensure an easy way to receive payments in your account.

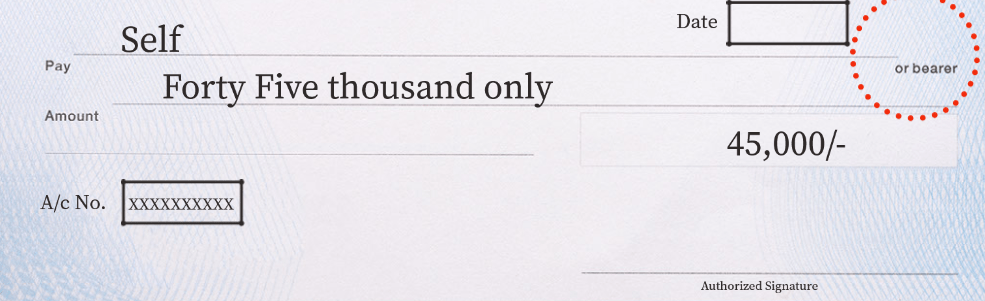

How to write a Bearer Cheque?

- The date is the most crucial aspect of any cheque, hence filling in the date is the first step.

- While writing a bearer cheque, mention ‘Self’ or pay to the order of cash.

- If the cheque is stolen or lost, anyone can withdraw your money. Hence, it is advisable to always write ‘only‘ after mentioning the amount in words. (Forty-five thousand only). It is easy for anyone to add something in front of that if only isn’t added.

- Remember to add Slash and dash after writing the amount in numbers. (45,000/-)

- Make sure to sign in the given space above the authorized signature.

There is no specified withdrawal limit for a bearer cheque. If the bearer cheque is more than Rs. 50,000, then the bank performs a KYC (know your customer) verification process. That means that the bank would check from the account holder if they have issued the cheque.

When the amount is less than Rs. 50,000, then banks do not perform such checks and whoever is carrying the cheque gets the money.

Types of Cheques

There are many types of cheques and they all have their distinct features. Banker’s cheque or pay order, Traveller’s cheque, post-dated cheques, etc.