Movie Case Study

The scene that you saw shows Shivraj (played by Sonu Sood) having a conversation with the distributor of his product. Shivraj is quite upset with the rising prices and is requesting the distributor to increase the price of the product. Although, he wants to increase the price by 300%. Shivraj continues to tell stories about how rising prices are affecting him. He says that his subordinates are asking for a higher salary.

In this blog, Learning Perspectives will explore the meaning of Inflation.

What is Inflation?

Inflation refers to the general rise of prices in the economy. The inflation rate is the rate at which the value of money (currency) is falling which leads to rising prices of goods and services. This in turn results in lower purchasing power over a period of time and it affects the standard of living too. In the overall economy, it causes unemployment, lowers the cost of borrowing, encourages investing, and discourages spending.

Similar to what Shivraj mentions in the scene, he narrates how he hasn’t got his house painted in over two years due to rising prices.

When prices decrease, another situation occurs, this is called deflation. In this case, the purchasing power of money increases.

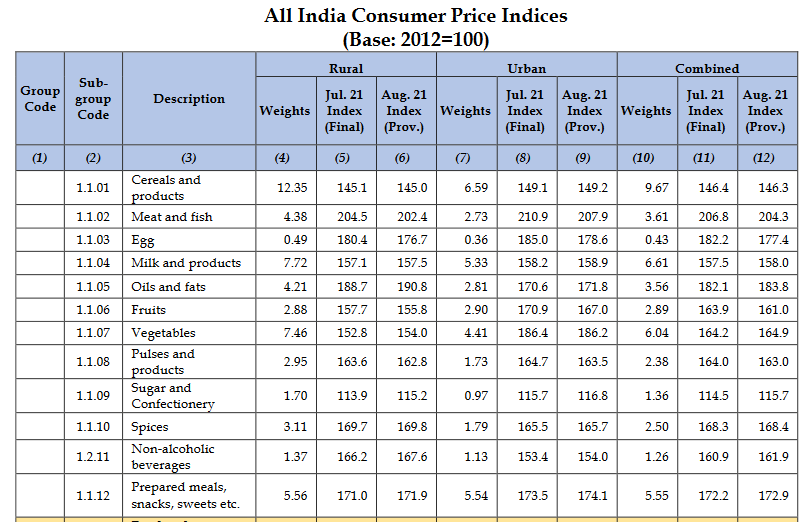

Consumer Price Index:

Inflation is measured through a tool called the consumer price index (CPI). This index measures the changes in the average prices of goods. These changes are compared through time. These goods include only consumer goods. It excludes goods purchased by businesses and the government. The consumer price index is sometimes called the cost of living index too.

The formula for Consumer Price Index

Cost of the basket in CY/ Cost of the basket in base year*100

A basket is defined as the goods that the country considers essential to calculate this index. The most recent report of CPI in India by the Ministry of Statistics and program Implementation indicates 25 goods in the goods basket. 2012 is the base year for the year 2021.

Reserve Bank of India (RBI), which is the central bank of the country has forecasted inflation of 5.7% for the January- March quarter of 2022 while for the next quarter, it is forecasted at 5%.

Understand Inflation with a Video

Causes of Inflation:

Inflation occurs due to many factors, this includes the economic environment of the country, financial health, and interest rates. Demand-pull inflation occurs when total spending is higher than the supply in the market. In other words, prices are pulled up by the pressure from the buyers’ total expenditure.

Cost-push Inflation occurs when there is an increase in the cost of production irrespective of the demand conditions. Costs increase by the labor, Price rise of raw materials, and increase in construction equipment build upward pressure on the price.