These bonds are different from regular bonds. Regular bonds are registered, and the ownership details are maintained along with the coupon rates. Hence, when the bond matures, the payment is made to the owner of the bond.

What are Bearer Bonds?

Debt instruments or bonds issued by governments or corporations are known as bearer bonds. Bearer bonds are unregistered, and hence they become easy to transfer. This is also the reason that they can be misused. Payment in this case is made to the holder of the bond, not necessarily to the owner. This misuse was clearly shown in the movie ‘Die Hard’.

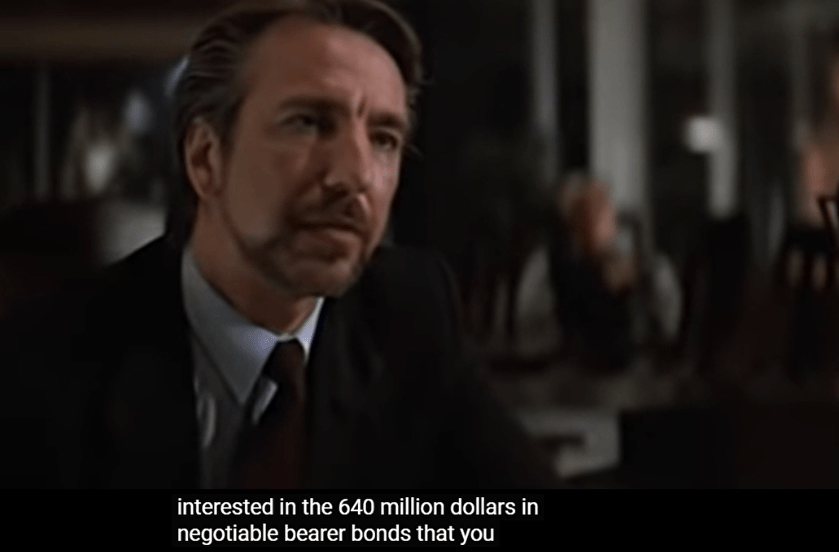

Movie Case Study

The scene shows Hans Gruber (played by Alan Rickman) posing as a terrorist who has taken people hostage in a Los Angeles building. He demands $640 million in negotiable bearer bonds.

The above scene from the movie depicts how bearer bonds can be manipulated. A bearer, as the name suggests, is anyone who carries the instrument and receives payment. Similar to a bearer check.

Features of a bearer bond

One of the unique features of this bond is its anonymity. For this reason, it has become a great instrument for money laundering and tax evasion. Many countries have slowly phased out this instrument. Anyone who gets their hands on this instrument can take advantage of the loopholes.

The shift away from physical certificates for ownership tracking and toward electronic record-keeping and dematerialization of securities is linked to the decrease in the use of bearer bonds. To improve efficiency, security, and transparency in financial markets, a large number of bonds issued today are held in electronic book-entry form.

Advantages of Bearer Bonds

Easily Transferrable

Bearer bond ownership transfers are comparatively easy. To change ownership, the bond certificate must be physically transferred from one party to another. This may be helpful in circumstances where it’s preferable to do transactions quickly and discreetly.

No Intermediary

Transactions with bearer bonds don’t need to be facilitated by banks or brokers. This can lower transaction costs and do away with the requirement for a centralized middleman throughout the ownership transfer process.

Flexibility

Bearer bonds are flexible since they are tangible documents. For those who prefer not to rely on computer systems for record-keeping or who want to hold their investments in tangible form, this can be useful.

Bearer Bonds Usage in Different Countries

Bearer bonds were once more common, but over time, a large number of them have been phased out or redeemed. Bearer bonds that are currently in circulation may still exist, but they are getting harder to find in the United States of America.

To increase transparency, efficiency, and compliance with anti-money laundering legislation, registered securities and electronic book-entry systems have been adopted.

India has taken action to resolve issues with financial transparency and stop illegal activities, including tax evasion and money laundering. To comply with international norms, bearer instrument issuing and trading have been somewhat restricted. However, bearer bonds are legal in India.

Financial laws are prone to modification, and changing international norms for financial security and transparency may have an impact on the usage of bearer instruments.