Movie Case Study

The scene that you just saw shows how Gopichand Verma (Played by Amrish Puri) is asking her maid (played by Revathi) to leave the house. She refuses to do so, to which he says sarcastically ‘Do you want provident fund and Gratuity before you leave?’

In this blog, Learning Perspectives will explore the meaning of Provident Fund and Gratuity.

What is Provident Fund?

A Provident fund is a scheme provided by the government. Employees give a portion of their salary to the provident fund (PF) and employers contribute half on behalf of the employees. This money gets deposited in the PF account which is managed by the government. At the time of retirement, this money can be withdrawn and a large corpus can be enjoyed by the employee. The amount is tax-free if withdrawn after 5 years of service.

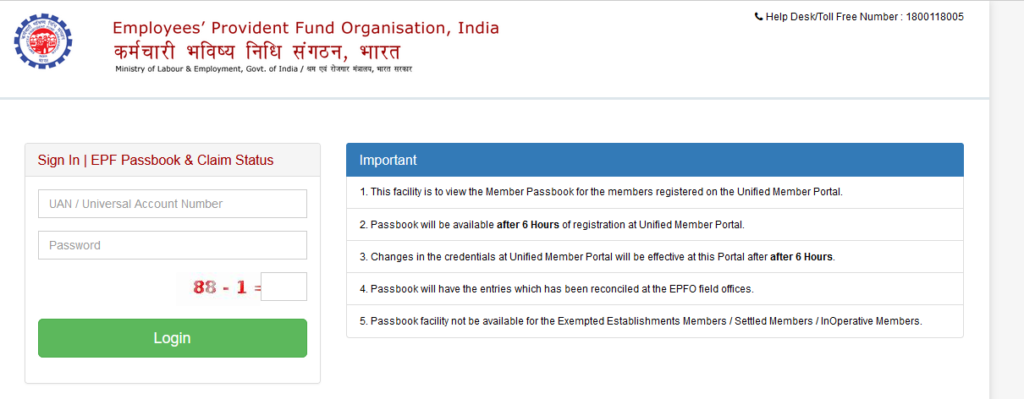

If an employee changes jobs frequently, then they can get the account transferred. Form 13 is required to move the PF account online. One can withdraw the PF amount online as well, this can be quickly done by visiting EPFO (Employee Provident Fund Organization)website.

Over the years, the process of transfer and withdrawal has become quite easy. EPFO allows a universal number (UAN) for each employee. Employees need to log in through UAN to check their account status.

EPFO Website

What is Gratuity?

Gratuity comes from the word ‘gratitude’. Prior to 1972 in India, it was paid as a form of gratitude to the employees by the employer for being loyal to the company at the time of their retirement. Post-1972, it became mandatory under the Gratuity payment act. Gratuity is paid to employees at the time of retirement by the employer. It can also be paid earlier under certain conditions.

Eligibility to receive gratuity starts when an employee has worked for at least 5 years with the company. For calculating the amount of gratuity to be received, the last drawn salary is used.

Workers are divided into two parts for this calculation:

- The ones covered under the Gratuity Payment Act of 1972

- Employees not covered under the Gratuity Payment Act of 1972

The formula for employees that are covered under the Gratuity Payment Act of 1972 is:

15*Last drawn salary*Working tenure/26

For the employees that are not covered under the Gratuity Payment Act. The formula is as follows:

15*Last drawn salary*Working tenure/30

The last drawn salary includes basic plus dearness allowance plus commission received on sales. The income tax department makes the process simpler by providing a free calculator to calculate gratuity. Find it here. According to section 10(10) of Income-tax, tax on gratuity is now exempt up to Rs. 20 lakhs.

[…] This serves as a retirement plan for the employee but there might be restrictions on withdrawals. Employee provident fund or National Pension scheme is different from this […]

[…] plans are curated for the retirement benefit of an individual. Retirement means when an individual decides to leave the workforce permanently. […]