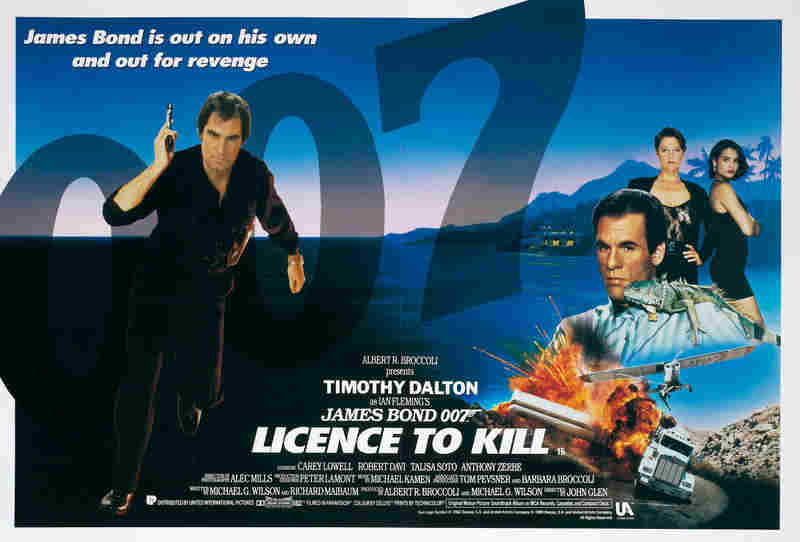

Movie Case Study

Please watch this scene carefully, what did you get out of it? I’m sure you remember the actor’s name. ‘My name is Bond, James Bond’ he mentions proudly.

In Accounts and finance, bonds are one of the reliable instruments for raising long-term finance just like Mr. Bond who reliably executes various assignments. Learning Perspectives will explore the meaning of bonds in this blog.

What are Bonds?

Bonds are long-term liabilities of a Company, they are classified under liabilities if they are used to raise finance, in simple words if I want money to run my business, I would issue bonds and people would purchase them giving me the lump-sum amount of money to run my business. For this reason, they are classified as liabilities. (Obligation to pay back). As a borrower of money, I would pay interest over the life of a bond. Generally, bonds have long-term maturity (15-20 years).

Parties

There are 2 parties while making a bond contract: the Issuer (Company that wants to raise funds) and the Investor (Who purchases bonds with a view of investment/saving). There are many types of Bonds such as Secured, Unsecured, term, serial, convertible bonds, etc.

India is the second largest emerging market for green bonds after China.

Green bonds are also a debt instrument in which a third party certifies that the proceeds are used for environment/clean projects.

[…] debt is used by the corporate and is not available to individuals. Bonds and commercial papers are forms of debt instruments that are used for raising funds. […]

[…] the scene. Shares are issued at discount as well, which means at an amount less than the par value. Bonds too, are issued at […]

[…] does not come without the risk of losing money. Investments can be done on many instruments. Bonds, mutual funds, shares to name a […]