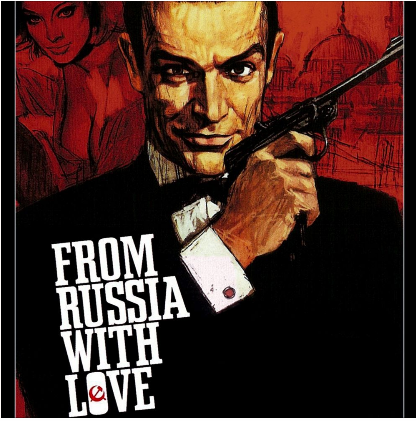

Case breakdown: From Russia with Love

The scene that you saw shows how Venice International Grand masters Championship. It shows a chess match between Kronsteen and MacAdams. As Kronsteen plays his mo, he moves his White knight chess piece and declares ‘check’. The term ‘Check’ in chess means that the opponent’s king is in danger.

In this blog, Learning Perspectives will explore the meaning of the white knight in finance.

What is White Knight?

A company that is about to be taken over may look for support and help from friends. These friendly people or companies are generally referred to as White Knights. Similar to a chess piece, the white knight, the knight on a chess board represents the professional soldier of medieval times whose job was to protect persons of rank.

A takeover generally involves the acquisition of a certain block of equity capital of a company. Hostile takeover takes place when the acquiring company plans to takeover the target company against the will of the target company.

Defense Strategies

A white knight is a defense strategy against a takeover. There are many other defense strategies against a takeover that can be discussed here:

1. Poison Pills

Existing shareholders are granted the right to buy bonds or preference stock that gets converted into the stock of the acquiring firm, in the event of the merger on very favorable terms.

2. Golden Parachutes:

The incumbent management is entitled to receive fabulous compensation in the event of a takeover.

3. Pac-man defense:

The target company makes a counter-bid for the stock of the bidder.

4. Asset Restructuring:

The target company sells its most precious assets, the crown’s jewels, and buys assets the bidder wants or that may pose anti-trust problems for it.

5. Liability Restructuring:

The target company repurchases its own shares at a substantial premium or issues shares to a friendly third party.

[…] Searching for a White Knight […]

[…] A company that is about to be taken over may look for support and help from friends. They can be referred to as White Knight. […]