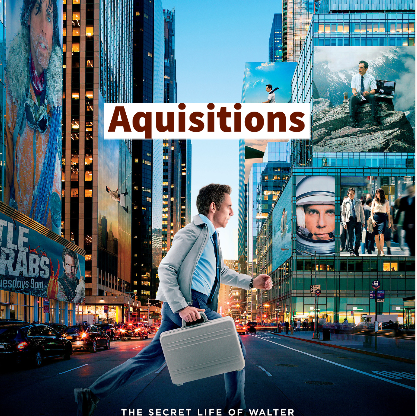

Movie Case Study

If you watch the above scene carefully from the movie Secret Life of Walter Mitty’, it shows how the company (The Life magazine) is being taken over by the new online division. Legally, the target company ceases to exist. Like in the scene above, they are talking about transition which means how the absorption of the company will take place. In this blog, Learning Perspectives will explore the meaning of Acquisitions.

What are Acquisitions?

When one company takes over another company and becomes the new owner in the process, this purchase is called an acquisition.

Acquiring company takes the majority stake in the acquired company (LIFE magazine, in this case). The legal structure of the company does not change but management changes and hence there is a cutting of staff (downsizing) and new divisions are created.

These changes can be stressful for the existing employees as it could mean that they might lose their jobs. To effectively manage this change, management must retain and resort to keeping the most valuable resources with the company.

Acquisitions are mostly done with a strategy in place. When companies are looking to expand to different markets, acquire new technologies or maybe decrease competition, they might resort to the acquisition of companies. This can be a part of the growth strategy too which means taking over a young company and incorporating its revenue stream into the business.

Understand Acquisition with a Video

[…] business strategies include initial public offerings (IPOs), acquisitions, buy-outs or declaring bankruptcy as well. Business owner forms a strategy and sometimes it can be […]

[…] internal functioning. Merger is a form of corporate restructuring. Many other activities such as acquisitions, leverage buyouts, performance improvement initiatives etc. also form part of corporate […]

[…] Takeovers […]

[…] Acquirer company is generally a larger company. Takeovers, commonly are a part of mergers and acquisitions. There are many types of takeovers, they can be friendly or […]

[…] takeover generally involves the acquisition of a certain block of equity capital of a company. Hostile takeover takes place when the acquiring […]