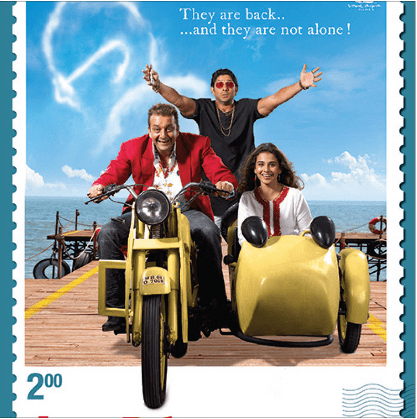

Case breakdown: Movie Lage Raho Munnabhai

The scene that you saw shows a school teacher who has come to the government office to collect his pension. This school teacher is upset with the corruption in the office as the officer keeps asking him for money (bribe). A radio jockey (played by Sanjay Dutt) advises him to give all the money he has to him.

The school teacher starts giving him each and every article he has and tells him the price of each. This embarrasses the officer and he signs his pension file before the teacher reaches for his last piece of clothing.

What is Pension?

Pension plans are curated for the retirement benefit of an individual. Retirement means when an individual decides to leave the workforce permanently. These plans provide financial stability and security to senior citizens of the country. They also ensure regular income through an annuity plan for retirement.

The retirement age in India ranges from 60 to 65. Pension in India is regulated by the Pension Fund Regulatory & Development Authority Act (PFRDA). The government constituted the National Pension Scheme (NPS) which aims to cultivate the habit of saving for retirement of all citizens. One also gets a tax deduction under section 80C.

Features of a Pension Plan:

Fixed Income:

One of the features of a pension plan is to provide a fixed income after retirement. this can be in the form of an annuity or a lump-sum amount.

Tax deductions:

Pension plans provide tax deductions as well. These are provided under sections 80C, 80CCD, 80CCC. An additional deduction for investments up to Rs. 50,000 in NPS. This is over and above the deduction of Rs. 1.5 lakh is available under section 80C of the Income Tax Act. 1961.

Duration of Pension:

The minimum eligibility period for receipt of a pension is 10 years. The minimum pension presently is Rs. 9000 per month. The maximum limit on pension is 50% of the highest pay in the Government of India (presently Rs. 1,25,000) per month. Pension is payable up to and including the date of death.

Types of Pension:

NPS

NPS is regulated by the government and the following are its features:

One can invest in it until the age of 60. One can withdraw 60% of the amount upon retirement while the rest of 40% will be invested to buy an annuity plan which offers regular income.

Public Provident Fund

PPF is a long-term instrument that has 15 years of tenure. This is one of the instruments that also provide interest on a compounded basis. One can deposit a maximum of Rs. 1.5 lakhs. Investing in PPF would help in availing tax deductions under 80C.

Annuity Plans

Annuity plans provide life cover along with regular income too. There are two types of annuity plans such as deferred and immediate annuity.

References: https://npscra.nsdl.co.in/tax-benefits-under-nps.php

https://pensionersportal.gov.in/

[…] National Pension Scheme (NPS) […]

[…] Pension plans give employees a share in the company’s profits. According to the annual and quarterly earnings of the company, employees would receive a share of the company’s profits. This serves as a retirement plan for the employee but there might be restrictions on withdrawals. Employee provident fund or National Pension scheme is different from this plan. […]