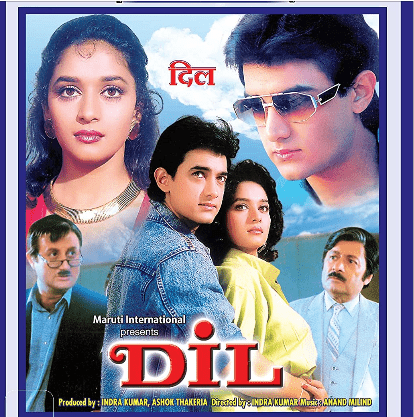

Case breakdown: Movie Dil

The scene that you saw shows Hazariprasad (played by Anupam Kher) distributing cash to the homeless. He is portrayed as a rich industrialist who seems to have a lot of wealth. He expresses to one of the beggars that he feels unfortunate because he does not have 10 hands to donate money to the unfortunate ones. Learning Perspectives will explore the meaning of charitable deduction in this blog.

What is a Charitable contribution?

Making a Charitable contribution or donation is looked upon as a good deed which essentially leads to good karma for an individual. In India, many Pandits and gurus recommend making charity to get rid of their bad karma. For almost every difficulty that one is facing in life, a charitable contribution is suggested. Businesses to receive and give out charitable donations.

Many times these charitable contributions are done with the intent of receiving a tax deduction.

A tax deduction is an amount that helps in lowering the tax liability of the taxpayer. This is beneficial because, on a lower income, the tax will be lower. Hence, all taxpayers look for the maximum deductions that they can avail themselves of. One can avail of deductions on savings, medical insurance premiums, PPF, and investment in mutual funds, to name a few.

According to the Income-tax act of 1961, section 80G allows taxpayers to claim deductions for charitable contributions made during the financial year. This deduction can be claimed by all taxpayers.

Payment:

If an individual makes the payment in kind, that means if one distributes food, clothes, water, material, etc. This donation is not eligible for deduction. While if you make a donation in cash up to Rs. 2,000, you will be eligible for a deduction.

If you want to make a donation of a larger amount i.e. above Rs. 2,000. It should be made either through the draft or a cheque to claim a deduction. This is the current limit in cash, earlier this was Rs. 10,000. (prior to 2017-18)

When one makes a charitable donation to a certain institution, an individual/company/firm can claim either 50% or 100% of this deduction under section 80G.

Donations to certain approved funds would qualify for a 50% deduction

- Trusts, charitable institutions.

- Donations for renovation or repairs of notified temples, etc.

Here the amount of deduction is 50 percent of the net qualifying amount [amount given as charity]. For example, if you donated Rs. 5,000 to a notified temple in this category, you can claim Rs. 2,500 i.e. 50% of Rs. 5,000.

The amount of deduction is 100 percent of qualifying donations in case the donation is made to the following funds/institutions:

- National Defence Fund, Prime Minister’s National Relief Fund,

- Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund (PM CARES FUND) Prime Minister’s Armenia Earthquake Relief Fund.

- Africa (Public Contributions – India) Fund.

- National Children’s Fund (from 1-4-2014).

- Government or approved association for promoting family planning.

- Universities and approved educational institutions of national eminence.

- National Foundation for Communal Harmony.

- Chief Minister’s Earthquake Relief Fund (Maharashtra),

- Zila Saksharta Samitis, National or State Blood Transfusion Council, Fund set up by State Government to provide medical relief to the poor,

- Army Central Welfare Fund,

- Indian Naval Benevolent Fund

- Air Force Central Welfare Fund,

- Andhra Pradesh Chief Minister’s Cyclone Relief Fund,

- National Illness Assistance Fund.

- Chief Minister’s Relief Fund or the Lt. Governor’s Relief Fund in respect of any State or Union Territory.

- National Sports Fund.

- National Cultural Fund.

- Fund for Technology Development and Application.

- Indian Olympic Association.

- Fund set up by the State Government of Gujarat exclusively for providing relief to victims of the earthquake in Gujarat,

- National Trust for Welfare of Persons with Autism, Cerebral palsy, Mental retardation and Multiple Disabilities,

- Sums paid between 26-1-2001 and 30-9-2001 to any eligible trust, institution, or fund for providing relief to Gujarat earthquake victims,

- The Swachh Bharat Kosh and the Clean Ganga Fund (from the assessment year 2015-16) and the National Fund for Control of Drug Abuse (from the assessment year 2016-17).

How to claim a deduction?

After donating, please be mindful to take a receipt from the institute. This would allow you to claim the deduction. Some important aspects that should be handy when filing the income tax return are:

- Name of the donee [to whom the contribution has been made]

- PAN number of the fund/institution

- Address of the fund/institution

- Amount of contribution.

References: www.incometaxindia.gov.in

[…] (NPS) which aims to cultivate the habit of saving for retirement of all citizens. One also gets a tax deduction under section […]

Very innovative way of teaching. Keep it up.