Movie Case Study

The scene that you just saw shows how Bruce Wayne brought the majority of the shares of Wayne enterprises when it went public (IPO). Wayne Enterprises (formerly WayneCorp) is a company in the DC Universe.

The owner of Wayne Enterprise is Bruce Wayne and his business manager is Lucius Fox. In this blog, Learning Perspectives will explore the meaning of IPO or initial public offering.

What is IPO?

IPO or initial public offering is the offering of equity shares of the company, which is followed by the listing of its shares on the stock market. Going public is never an easy decision for a company to make, it is a complex decision that involves careful considerations. The company needs to weigh its benefits against the costs to reach a viable decision.

Why IPO:

Companies generally go public to access capital. When the public puts in the shares being sold in the market. The company gets money or capital. This is the principal motivator for any company to go public. Many entrepreneurs think they will command greater respect once they have gone public. A public company may command greater respect. Promoters of a company, eventually like their investment to become liquid, this becomes possible when the company becomes liquid.

Process of IPO:

Book building is a process that involves inviting subscriptions to public offers of securities through a process of tendering. Prior to book-building, the merchant banker fixes the floor price in consultation with the issuer. The floor price is the minimum price at which bids can be made.

Eligible investors can fill out a bid-cum application form and submit the same to the lead manager running the book.

The lead manager assesses the responses to the issue and ascertains the price at which the demand is sufficient to match the size of the issue. He further decides on the final subscription price and works out the pattern of allotment.

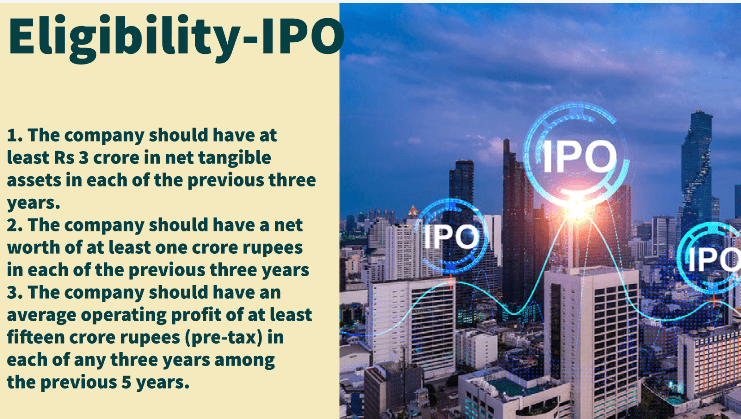

Eligibility for IPO

Companies need to be eligible for launching an IPO and hence SEBI issues certain conditions for the same.

(a) Net Tangible Assets of at least Rs. 3 crores in each of the preceding three full years

of which not more than 50% are held in monetary assets. However, the limit of fifty

percent on monetary assets shall not be applicable in case the public offer is made

entirely through an offer for sale.

(b) Minimum of Rs. 15 crores as average pre-tax operating profit in at least three of the

immediately preceding five years.

(c) Net worth of at least Rs. 1 crore in each of the preceding three full years.

(d) If the company has changed its name within the last one year, at least 50% of revenue for the preceding 1 year should be from the activity suggested by the new name.

(e) The aggregate of the proposed issue and all previous issues made in the same

financial year in terms of issue size does not exceed five times its pre-issue net worth as per the audited balance sheet of the preceding financial year.

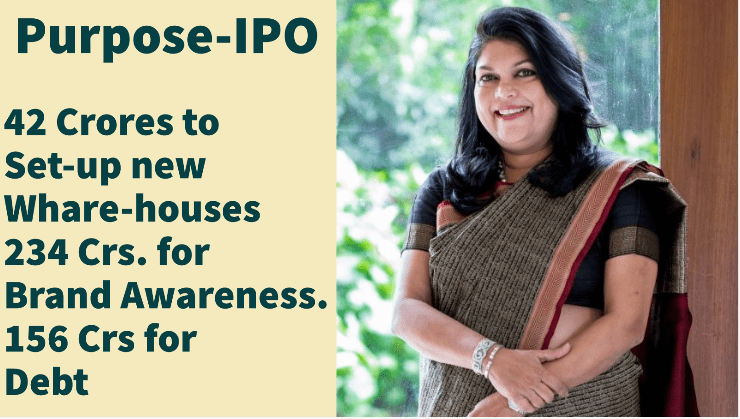

Nykaa Case Study:

Nykaa was founded by Falguni Nayyar in 2012. Nykaa operated in 3 business segments: beauty care products, personal care products, and fashion products.

They choose to conduct an IPO to set up new warehouses, create brand awareness, and re-pay their debt. This would help the company significantly to grow and maintain its brand image as well. Nykaa had raised close to Rs. 2,400 crores from anchor investors and Rs. 5,400 crores was raised during the IPO.

Understand IPO with a Video

References: https://www.sebi.gov.in/sebi_data/commondocs/subsection1_p.pdf

[…] to help them in doing this. Investment/Merchant bankers may advise the company to take a route of IPO or FPO or QIP, (Initial Public offer, Further public offer and Qualified institutional placement… depending on company’s financial statements, their needs and the future direction of the […]

[…] is used in initial public offerings (IPOs) to find the optimal price of the stock. In the process of IPO, the company decides on the number of […]