Movie Case Study

The movie scene shows Raunak (played by Anupam Kher) transferring his shares of the sugar mill to Sahiba Garewal (played by Aishwarya Rai). In this blog, learning Perspectives will explore the meaning of share transfer.

What is the meaning of Share Transfer?

Companies raise capital for their regular business. This capital can either be an equal mix of debt and equity or a ratio that is suitable for the company. Raising funds through equity is generally in the form of equity or preference shares. These shares are transferable in nature. This share transfer can be done through an agreement or a deal.

This provision is provided in the Companies act of 2013 under section 56. Transfer of shares means voluntarily handing over the rights and duties associated with the shares to another member.

The procedure of Share Transfer:

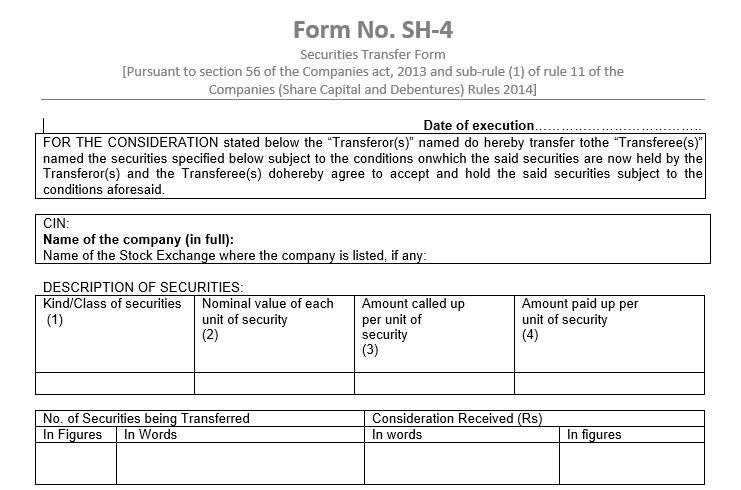

- The procedure involves a duly filled stamped form (SH-4) i.e. securities transfer form. It should be dated and executed by or on behalf of the transferor and the transferee and specify the name, address, and occupation.

- This form should be sent by the transferor (Raunak, in this case) to the transferee (Sahiba) in a period of sixty days from the date of the execution, along with the certificate relating to the securities, or if no such certificate is in existence, along with the letter of allotment of securities.

- Every company should deliver the certificates of all securities allotted, transferred, or transmitted: a) Within a period of two months from the date of incorporation. b) Within a period of two months from the date of allotment, in the case of any allotment of any of its shares;

Documents Required for Share Transfer:

- PAN copy of both transferor and transfree.

- Duly filled and stamped SH-4 form.

- Appropriate Stamp duty for transfer of shares. 25 paise for every Rs.100 value of the percentage that is transferred.

- Transferor’s original share certificate

If the company fails to comply with the Companies act provisions then the organization which is making the transfer is liable to a penalty of fifty thousand rupees.