Movie Case Study

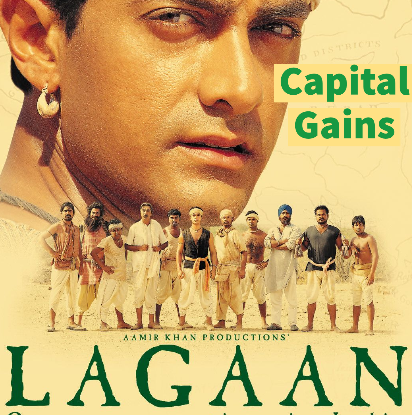

If you watch the scene carefully, you’ll realize that Lagaan(tax) for three years would be exempted if a cricket match is won by Aamir khan and the villagers (Stakes were very high). Similarly in modern taxation, long-term capital gains if held for more than 3 years, there are consequences. This blog, Learning Perspectives will explore the meaning of capital gains.

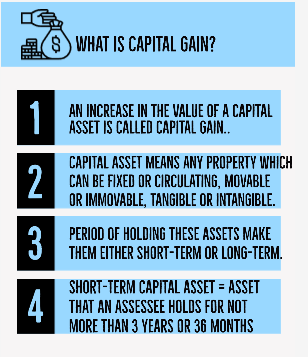

What is Capital Gain Lagaan?

An increase in the value of a capital asset is called capital gain. Income from capital gain is one of the heads under taxation. Capital Asset means any property which can be fixed or circulating, movable or immovable, tangible or intangible. For e.g. they could be diamonds, house property, listed shares, unlisted shares, or unity of equity-oriented mutual fund. The period of holding these assets makes them either short-term or long-term.

LTCG and STCG are two common terms used in taxation. LTCG means long-term capital gains while STCG is the short-term capital gain. Short-term capital asset mean any asset that an assessee holds for not more than 3 years or 36 months. If the asset is held for more than 3 years, it’s called a long-term capital asset.

A long-term capital gain arises on the transfer of a long-term capital asset. Long-term capital gain is generally taxable at a lower rate. e.g. transfer of land and building.Capital gain that arises from the transfer of house property.

Let’s say a residential house property is transferred. Just like captain Russel, the tax department lays down certain conditions. For e.g. you sold a residential house property for Rs. 50,00,000 and with this money, you purchased another house property for Rs. 30,00,000. Taxation Exemption will be on the lower of Rs. 50,00,000 (capital gain) and investment of Rs. 30,00,000. So 30,00,000 would be exempt.

Another condition given is that if the new house is sold within 3 years of its acquisition, the exemption will be taken back.

Reference: Guide to Income Tax by VK and Monika Singhania

[…] Heir can decide to sell the property too. Any capital gain arising by selling that property would also accrue to […]

[…] an income is derived from barter in India, it can be considered as capital gains or profits of gains from business or profession if the goods are traded as stocks. Although you may […]