Movie Case Study

The scene that you saw shows Deepak (played by Govinda), who runs his own transport business. His colleague (played by Rajpal Yadav) comes running to him to know the status of the collections made by the company.

In this blog, Learning Perspectives will explore the meaning of Collections in business.

What are Collections?

Every business makes collections. This is done by the companies to meet their financial obligations timely. Collections mean obtaining cash from clients so that they have enough cash to sustain their business.

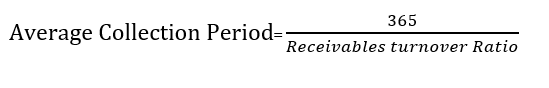

Average Collection Period

The average collection period is another term that comes into existence here. It is also called the receivables turnover ratio. Accounts receivable (A/R) is another term in accounts that is the payment that a business would receive in the future. These payments are to be made either by the customers or clients for services provided by the Company but the payment is yet to be received.

Understand Collections with a Video

The company always wants to keep its average collection period shorter. This is a beneficial situation as it would mean that the business would receive these payments earlier.

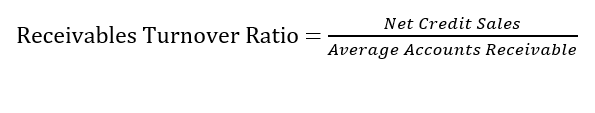

Receivables Turnover Ratio

The receivables turnover ratio calculates on average how many times does the company collects its receivables within a year. A higher receivables ratio would indicate a positive sign. It would mean that the company can quickly convert its receivables into cash. It is given by the following formula:

Example:

Assume two fictional sporting companies Nadidas and Aike. Below are the sales and accounts receivables given according to the income statement and the balance sheet.

| Company | Nadidas | Aike |

| Year | 2019 | 2019 |

| Sales | 4,30,000 | 14,954,000 |

| Company | Nadidas (2019) | 2018 | Aike (2019) | 2018 |

| Accounts Receivable | 84,300 | 60,000 | 27,14,400 | 25,99,200 |

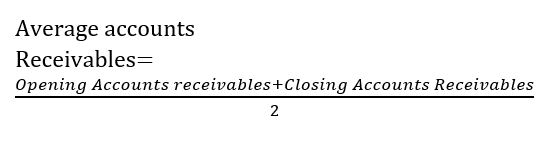

Average accounts receivables are calculated by adding the opening A/R and closing A/R and dividing it by two.

Average Accounts receivables for Nadidas (2019) = 84,300+60,000/2= 72,150

Aike = 26,56,800

Calculating Receivales turnover = Nadidas = 4,30,000/72,150= 5.95

Aike= 14,954,000/26,56,800= 5.62

5.95 turnover for Nadidas indicates a turnover of almost 6 times a year. Aike has slightly lesser than Nadidas.

When we convert this into an average collection period, we get a better understanding.

Nadidas= 365/5.95 =61.3 days

Aike= 365/5.62=64.94 days

Nadidas average collection period stands at approximately 2 months (61.3 days) while Aike’s collection period is a little more than 2 months.

Very innovative way. Keep it up.