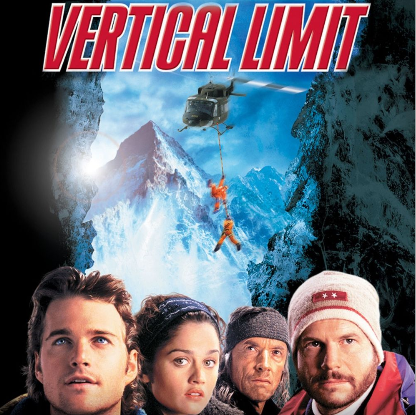

Movie Case Study

The scene that you saw shows Annie (played by Robin Tunney), Peter (played by Chris O’ Donnell), and Dad struggling on a single rope. Dad asks Peter to cut him loose as the rope won’t be able to take the weight. As Annie and Peter, his children are struggling to make a decision. Father shouts to Peter, “you’re gonna kill your sister”. Here the risk was 3 dead people while the return is 2 people making out alive from the situation.

In this blog, Learning Perspectives will explore the meaning of Risk and Return of a portfolio.

What is the Risk and return of a portfolio?

Investors don’t want to put all their eggs in one basket. A portfolio means a collection of different stocks and securities. This is done to mitigate risk. This means that the risk and returns of stocks are not measured in isolation but as a whole. Similar, to the scene that we saw, if all of them were on separate ropes, it wouldn’t have mattered but now it does as all three of them are on the same rope.

Annie, Peter, and Dad have separate weights and are able to hang on that rope. Annie may be contributing to 30% of the total weight on that rope. Similarly, the expected return on a portfolio is simply the weighted average of the expected returns on the assets included in the portfolio.

For example: when a portfolio consists of 2 securities:

Expected Return= E(R1)w1+ E(R2) (1-w1)

w1= Weight assigned to security 1 i.e. proportion of portfolio invested in security 1

E(R1)= Expected return on security 1,

1-w1= Proportion of portfolio invested in security 2

E(R2)= Expected return of security 2

Illustration:

Let’s assume, I created a portfolio with two securities. Security A offers a return of 10% while security B offers a return of 15%. Let’s say I invested 40% of the money in Security A and 60% of the money in security B.

Then the expected return on this portfolio will look like this:

E(Rp)= E(RA)w1+ E(RB) (1-w1)

=.40*10+.60*15= 13%

This means the expected portfolio return is 13%. The same can be calculated for 5 securities or n number of securities.

The return of the stocks or securities depends on the state of the economy. Diversification is the main strategy through which risk can be mitigated in the portfolio while investing. When the portfolio has one security, the risk of the portfolio is the risk of the single stock included in that portfolio.

As second security is added, the portfolio risk decreases but at a decreasing rate. As we keep adding securities, risk keeps mitigating but empirical studies suggest, that risk reduction is achieved by forming a portfolio of about ten securities. Thereafter, any gain tends to be negligible.

Understand Risk & Return on a portfolio with a Video

References: Financial Management by Prasanna Chandra

[…] or assets with the expectation of earning a return. While making an investment, the concept of risk and return is involved. Generally, low risks fetch lower returns and high risks fetch higher returns. While […]

[…] generally driven by large numbers and is dependent on a statistical analysis of facts and figures. Portfolio decisions, investments, financial forecasting, and breakeven analysis are done through statistical […]

[…] such a person would balance his portfolio, by investing equally between debt and equity. The equity market is considered risky in comparison […]

[…] as mutual funds, stocks, bonds, futures, options, debt instruments, etc. Investors can create portfolios according to their risk appetite which earns them high financial returns. The risk appetite of an […]

[…] is the combination of debt and equity in a company. Each project’s HR should reflect the risk of the project, not the risk associated with the firm’s average […]