Movie Case Study

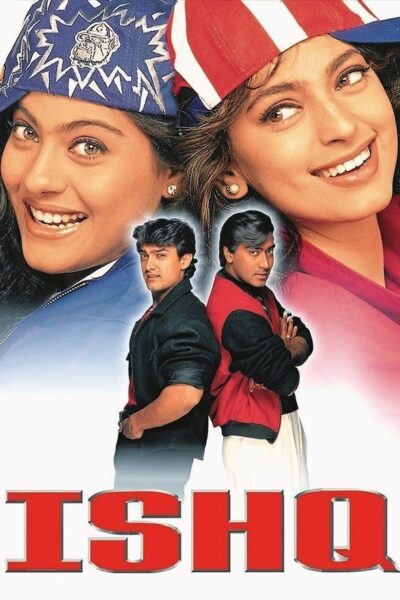

Ajay Rai’s (played by Ajay Devgan) father is upset with his spendthrift attitude and decides to call the bank manager to freeze his bank account.

The bank Manager decides to freeze Ajay Rai’s account, but Ajay Rai’s fake father (played by Aamir Khan) walks into the bank and starts scolding the bank manager.

This blog, Learning Perspectives will explore the meaning of what is a frozen account.

What is a Frozen Account?

An account freeze means when the account holder is unable to withdraw money from that account. Banks generally freeze accounts in the following situations:

- When a creditor seeks judgment against the account holder for an unpaid amount.

- There’s suspicious or illegal activity in the account.

- If money laundering is suspected.

- Government can also request a bank freeze if any loans or taxes are unpaid.

- If there seems to be terrorist financing, banks can freeze accounts.

- If there are security breaches, banks might resort to freezing accounts.

- Any fraudulent activity can lead to the freezing of the account.

One can still receive deposits in the account but withdrawals and transfers will be stopped in a frozen account. The money that just entered the account will also be frozen, which means the holder cannot withdraw it.

Closed Vs. Frozen A/c:

Now, the fake father (Aamir Khan) tells the manager, why would I call you to ‘CLOSE’ the account. The closing account is different from freezing the account. If the bank were to close Ajay Rai’s account, the bank would pay the balance of money that is in the account. One would receive this money either in the form of a cheque or demand draft after all applications and checks are in place. In the case of a frozen account, the balance in the account remains in the bank account but one is not able to use it. In fact, a frozen account cannot be closed.

Dormant Vs. Frozen A/c:

A dormant account is different from a frozen account, the dormant account is one that has had no financial activity for the past 24 months. Accounts become inactive when there is no activity for 12 months. In order to reactivate the dormant account a written application, Identity, and address proof is required by the bank.

Unfreezing Bank Account:

The best-known way to unfreeze a frozen account is to erase the judgment against the holder of the account. Once the creditor is paid, the bank will unfreeze the account, but if this is not the case and it has been unjustly frozen, then you can also approach the bank’s customer care to get matters sorted. The last resort would be to approach the RBI (Reserve Bank of India) to get help in unfreezing accounts.