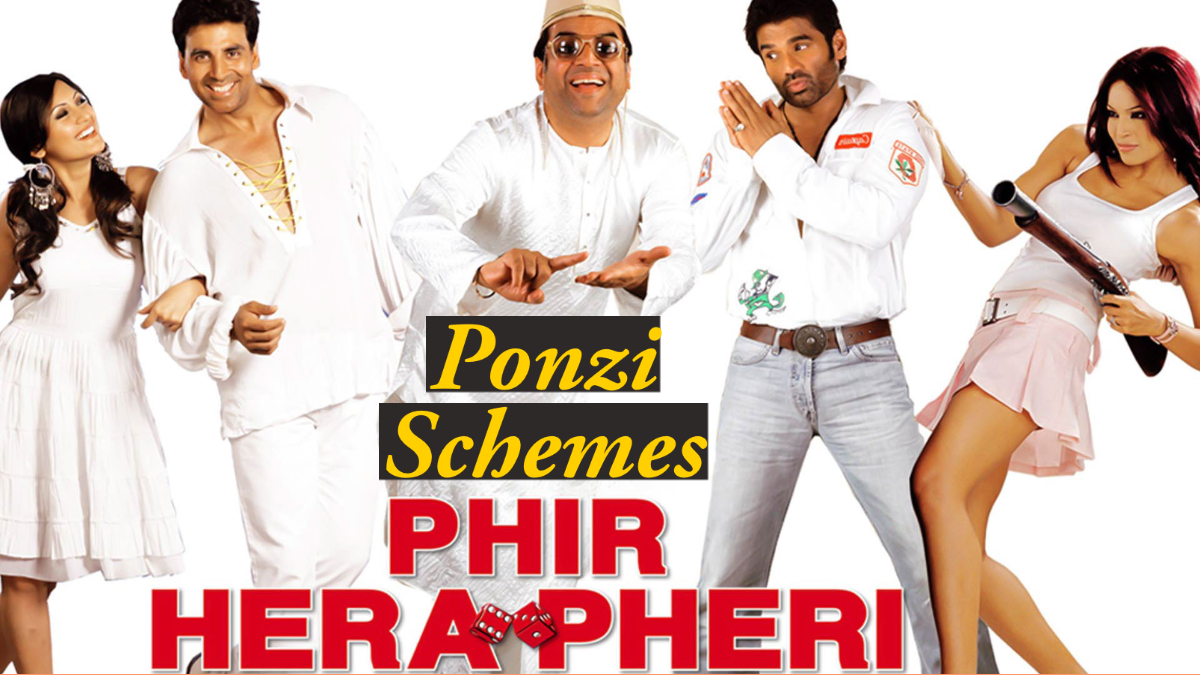

Movie Case Study

The scene that you just saw shows Anuradha (played by Bipasha Basu) talking about an investment to Raju (played by Suniel Shetty). She mentions that her company invests in a foreign company that doubles the money in 7 days. Raju, Shyam, and Baburao give Rs. 1 Crore so that they can double their money in 15 days.

Learning Perspectives will explore the meaning of a Ponzi Scheme in this blog.

What is a Ponzi Scheme?

A scheme considered fraudulent in nature that promises a high return to investors. In the scene you saw, Anuradha promises a higher return to Raju, Shyam, and Baburao. Ponzi schemes are illegal investment plans that scam people out of their money. These schemes sometimes look similar to pyramid investing.

Ponzi Scheme Origins

The word “Ponzi” comes from the founder’s name, “Charles Ponzi”. Charles Ponzi was a con artist who claimed to investors that they would get a 50% return in 45 days. Later, he started, paying earlier investors with the money he acquired from new investors. This went on for many years before he was arrested. Hence, a Ponzi scheme relies on a large number of victims to make it work.

Bernie Madoff was born on April 29, 1938, in Queens, New York, and attended Far Rockaway High School in Queens. He ran the biggest Ponzi scheme, and in 2008 he was convicted for it.

Red Flags for Investors

a) If you are being offered a high return with little or no risk then it might be a Ponzi scheme.

b) Are you investing through a registered fund? If not, then double-checking is advised.

c) Have you checked the paperwork and all the documents?

d) Scheme has some secret loopholes and is not explained correctly.

In the above scene, Shyam had been skeptical about signing the papers for this investment. While Baburao and Raju are convinced. In this scene, Anuradha convinces Shyam too. This causes all three of them to lose their money. One needs to be cautious before investing the savings of a lifetime. No scheme would double the money in 15 days or 30 days for that matter.

Understand Ponzi Scheme with a Video

Hence it is okay to take risks but be mindful of what is a risk and what can be a scam.

SEBI

SEBI’s (Securities Exchange Board of India) powers are primarily meant to act against illegal collective investment schemes and curb insider trading. The regulator now has powers to ensure that such schemes comply with its regulations or it can carry out investigations, attach assets, and authorize search and seizure operations to crack down on so-called Ponzi schemes.

References:

https://www.thehindubusinessline.com/news/education/sebi-vs-ponzi-schemes/article20647658.ece