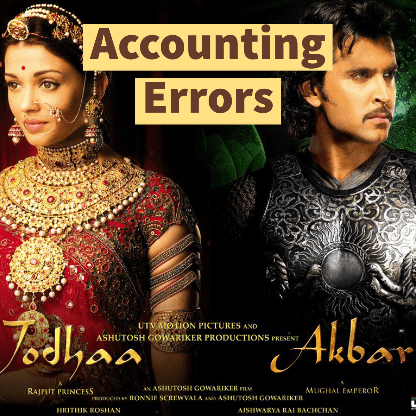

Movie Case Study

Errors in accounting generally occur due to human error. These errors are mostly recognized when closing the books. Most errors can be found and rectified.

Similar to how Hrithik Roshan (Akbar) finds his wife (Jodha) in this scene among many women who are all covered by head-covering (or ghunghat). An accountant too is able to find an error amongst many journal entries and make corrections.

This blog, Learning Perspectives will explore how to find accounting errors.

Finding accounting Errors

There are three types of accounting errors:

- Error of Omission

- Error of Commission

- Errors of Principles

Errors of Omission:

As the name suggests, this kind of error occurs when an entry or transaction is completely omitted or missed. In this error, the entry is not recorded. These are one of the most common errors to occur. Transactions can be omitted either partially or completely. When a transaction is omitted completely one cannot find it through the ‘Trial Balance’ or TB while if the transaction has been missed partially, one can find it.

For e.g. expense incurred to buy stationary has been missed and not recorded would mean there is no debit or credit in the ledger. Hence it becomes difficult to track it from the trial balance. In case of partial omission, a debit or credit of an entry is missed. For e.g. Goods sold to X for Rs. 5,500 would mean Sales A/c would be debited to X’s account for Rs. 5,500. So an accountant did debit the sales book but forgot to credit X’s account.

Errors of Commission:

The error of commission is posting of incorrect amount while recording the entry. This can be due to a calculation mistake, posting on the wrong side of the book (debit or credit) or an entry posted twice. These kinds of errors may or may not lead to differences in the trial balance. These errors can occur because of a lack of expertise, inattentiveness, or neglect of the accountant.

Errors of Principle:

These errors are not in alignment with the principles of accounting. These errors generally go against the GAAP principles and generally occur due to a lack of sufficient knowledge of accounting principles.

For e.g. Purchase of machinery is recorded as an expense, i.e. capital expenditure is recorded as revenue expenditure. Capital expenditure is an expense that is incurred on fixed assets that would reap benefits over a period of time while revenue expenditure is incurred for normal day-to-day operations of the business. Hence machinery shouldn’t be recorded as an expense but rather treated as an Asset for the business.

How to resolve these errors:

- Keeping track of bills and invoices from suppliers and vendors helps in validating if all details are entered in the system correctly.

- An audit trail is also necessary to resolve any material discrepancy in the accounts.

- Bank reconciliation is a good tool to check for any difference between accounts, this helps in finding errors before the end of the period.

- Internal controls also help the organizations to detect errors.