Movie Case Study

The scene that you saw shows Dr. Siddhant Arya (played by Naseeruddin Shah) announcing a hundred percent dividend for all the shareholders of Technotranics. He informs that the company has made a profit of $ 400 million this year. He is also grateful to all the investors who have had faith in him.

In this blog, Learning Perspectives will explore the meaning of dividends.

What Are Dividends?

Sometimes, people who believe in the vision of the company, join the owner of the company and start by investing money in the company. These investors become the shareholder of the company, as now they have a share or stake in the company. In accounts, shareholders’ equity means owners’ money/share/equity. Similar to the scene that you saw, Dr. Siddhant Arya says that all investors had faith in him means that he was allowed to take on a risky project as shareholders invested in the project.

Now, as the project did well and earned a profit, he declared a hundred percent dividend which means, out of the profit earned by the company he is distributing a proportion (100% in this case) of the earnings to the shareholders. This can be seen as a reward for the shareholders for taking a risk and investing in the company.

Example

The dividend comes out of the earnings of the company and is distributed to the shareholders. For example: Let’s say you own 5 shares of ONGC. After the quarter-end, the company declares a 0.50 paise dividend per share. Then, you as a holder of these 5 shares, will receive a dividend of 5*0.50= Rs. 2.5.

Shareholders hold a large number of shares in the company and hence they earn a dividend for the risk of investing in a company. Many companies such as Google or Facebook do not pay out dividends to the shareholder.

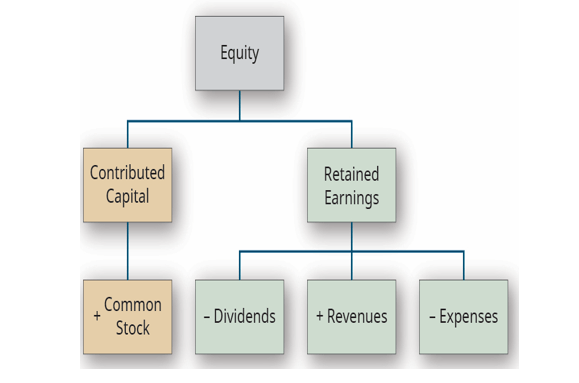

In accounting, the name for money invested by the owner is given as Common stock. It is the capital invested by the owner of the company. Shareholders’ equity has two main parts namely common stock and retained earnings.

Retained Earnings

Retained earnings are the amount of net income left after the dividend is distributed. (Think piggy bank, a small portion of your pocket money would go in this). In other words, the portion that is left is retained further in the business. Profit= Revenue (Sales)- Expenses

Retained Earnings of a business= Profit Earned-Dividend distribution

Dividends and Taxation

The dividend received during the financial year 2020-21 and onwards shall now be taxable in the hands of the shareholders.

According to the Finance act 2020, shareholders have to pay tax on dividend income. TDS or tax deducted at source was also imposed under this act of 10% on dividend income paid that is greater than Rs. 5,000. This holds true if the dividend is being received by a domestic company. In the case of a foreign company, then that income will be added to income from other sources and will be charged according to the applicable income tax slabs.

References: https://www.incometaxindia.gov.in/Tutorials/Tax%20treatment%20of%20dividend%20received.pdf