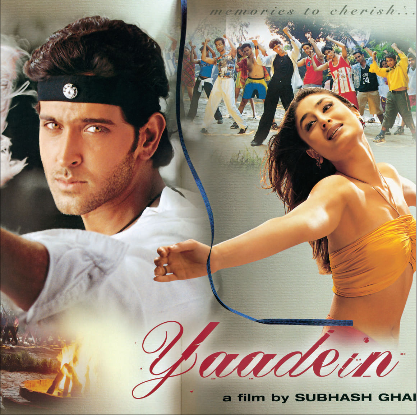

Case breakdown: Movie Yaadein

The scene that you saw shows how Ronit (played by Hrithik Roshan) is questioning the investors who are attending the Globex International Merger between two business houses. These two family businesses also decided to marry their kids so that their business can grow even further.

Monishka (played by Kiran Rathod) is also agreeing with Ronit when she says a business merger doesn’t entail marriage which is based on cash flow but rather should be based on true love.

In this blog, Learning Perspectives explore the meaning of Mergers.

What are Mergers?

When two or more companies join together, it is referred to as a merger. This leads to significant changes in organizational structures and internal functioning. A Merger is a form of corporate restructuring. Many other activities such as acquisitions, leveraged buyouts, performance improvement initiatives, etc. also form part of corporate restructuring. Mergers may involve absorption and consolidation. It is mainly done by companies to increase their market share.

Absorption as the name suggests means one company acquires another company. While Consolidation means, two companies combine to form a new company.

Types of Mergers:

Horizontal Merger

This merger represents a merger of firms engaged in the same line of the business/industry. These mergers are quite common as they seek to achieve synergies. Merging companies get bigger markets and clients. A classic example to understand this would be a merger of Pepsi and Coke. Both companies are in the same line of business. PVR and INOX merged to explore bigger markets in 2022. Both are cinema franchises, they combine to utilize advertising revenues, lower rental costs and convenience fees.

Vertical Merger

A merger of firms engaged at different stages of production in an industry. It can be the company engaging in the supply chain. A shoe manufacturer merge with a leather manufacturer. For example, The merger of a company called ONGC (Oil and Natural Gas Corporation), a company engaged in oil exploration and production with a company HPCL (Hindustan Petroleum Corporation Limited), a company engaged in refining and marketing may improve coordination and control.

Conglomerate Merger

This merger deals with a merger of firms engaged in unrelated lines of business. For example, ITC is one of the biggest conglomerates spanning hotels, paper boards, agricultural products, and FMCG or fast-moving consumer goods.

Reasons for Mergers:

There are many reasons why two companies decide to join together. These are related to growth, diversification, economies of scale, managerial effectiveness, lower financing costs, and so on.

Strategic benefit:

If a firm has decided to expand in a particular industry, sometimes looks for merger & acquisition which offers several strategic advantages. It offers a special timing advantage because the merger enables a firm to leap several stages in the process of expansion. It may also be advantageous in terms of cost and risk.

Economies of Scale:

Economies of Scale:

To Widen the scope of activities and skills/assets, many firms decide to merge. For example P&G can enjoy economies of scale if it acquires a consumer product company that benefits from its highly regarded consumer marketing skills.

Complimentary Resources:

If two companies have complementary resources, it makes sense for them to merge. For example, a startup that has innovative products would not have the marketing capabilities of a bigger firm in the same industry. These two can decide to merge to successfully use each other’s resources and have a bigger market share.

Recent Example:

Zomato recently was looking to be merged with Grofers. Zomato, a food delivery app was looking to explore new public markets. Grofers is an online grocery e-retailer, which touched the $1 billion club recently. Zomato acquired a 9.16% stake in Grofers. This deal will help Zomato to come back into the grocery segment.

[…] Mergers […]

[…] target company. Acquirer company is generally a larger company. Takeovers, commonly are a part of mergers and acquisitions. There are many types of takeovers, they can be friendly or […]