Movie Case Study

Watch this scene carefully from the movie ‘Kapoor and Sons, this scene shows how the lady in the scene wants to withdraw money from her FD, while her son keeps on telling her not to do it. In the next scene, she finds out that her husband has already withdrawn money from her FD. Fixed deposits are popularly known in India as FDs. Learning Perspectives will explore the meaning of fixed deposits in this blog.

What are Fixed Deposits?

Fixed deposits (FDs) are the most trusted instrument of investment in our country. FDs are provided by banks at high-interest rates for a given duration. One can pay a lump-sum amount and earn interest on it for the duration taken. Some banks also provide loans against FDs. One can also avail of tax benefits under section 80C.

Duration of Fixed Deposits

These are accepted in India ranging from 7 days to 10 years. For each period there’s an interest rate that’s attached to it. It is unique to each bank. In an event of premature withdrawal, the bank is entitled to levy a penalty of interest i.e. cut the interest rate by some percentage points.

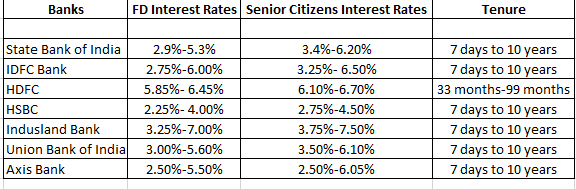

FD rates as of February 2021 for various banks are listed below:

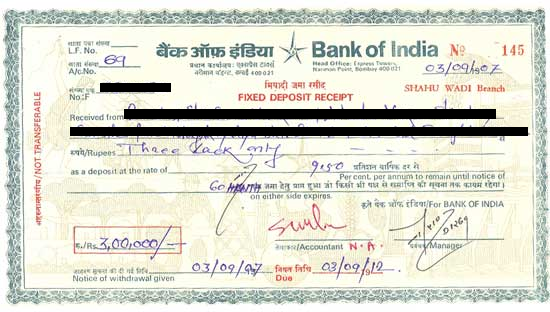

Below is a snapshot of a certificate of deposit that you receive once you put money in a lump sum for FD in a bank, if you would want to renew this FD, you simply would write the same at the back of the certificate along with a revenue stamp.

FD Certificate

[…] Similarly someone with a low risk appetite would invest in government bonds or debt instruments (FD, PPF etc.) to get an assured […]

[…] Fixed deposits (FDs) are the most trusted instrument of investment in our country. FDs are provided by banks at high-interest rates for a given duration. One can pay a lump-sum amount and earn interest on it for the duration taken. Some banks also provide loans against FDs. One can also avail of tax benefits under section 80C. […]

[…] The debt market includes instruments such as bonds, government-backed securities such as PPF, NPS, fixed deposits, […]