Movie Case Study

Similar to the scene that you just saw, Drew Barrymore is carrying the prince forward, in accounts, balances are carried forward from one period to the next period and in taxation, unadjusted losses can be carried forward to future years.

What is Carry Forward?

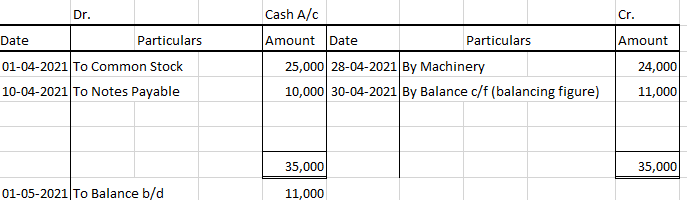

In accounting carrying forward means carrying forward the balance of an account to the next period.

For e.g. if the closing balance of the cash account in April 2021 is Rs. 25,000, then the opening balance of cash for May 2021 would be Rs. 25,000 as it has been carried forward. In accounts, we use terms such as balance b/d which means balance brought down, and c/f which means carried forward. These are used in a ledger or T-accounts.

Set-off:

Before understanding what is carried forward, let’s understand what exactly is set off. In taxation, Set-off means adjusting losses with income or profit of that particular year. Losses that are not set off are carried forward to successive years.

Under taxation, there are 5 heads of Income:

- Income from Salary

- Income from House Property

- Income from Capital gains

- Income from Business & Profession

- Income from Other Sources

In taxation, a set-off could be an intra-head or inter-head set-off.

Intra-head set-off

Loss from business 1 can be set off from the income of business 2, where 1 and 2 are the two sources of business.

There are some exceptions to this rule:

- Losses from Speculative businesses can only be set off by income from speculative businesses.

- Loss from the activity of owning and maintaining racehorses will be set off only against the profit from the activity of owning and maintaining racehorses.

- The long-term capital loss will only be adjusted towards long-term capital gains. However, a short-term capital loss can be set off against both long-term capital gains and short-term capital gains.

- Losses from a specified business will be set off only against the profit of specified businesses.

Inter head Set-off:

Under this set-off, taxpayers can set off remaining losses against income from other heads. For e.g. loss from house property can be set off against salary income.

Un-adjusted losses can be carried forward to future years for adjustments against the income of these years. Set-off losses mean adjusting the losses against the profit or income of that particular year.

After making these set-offs, there still could be unadjusted losses that would be carried forward to future years for adjustment against the income of those years.