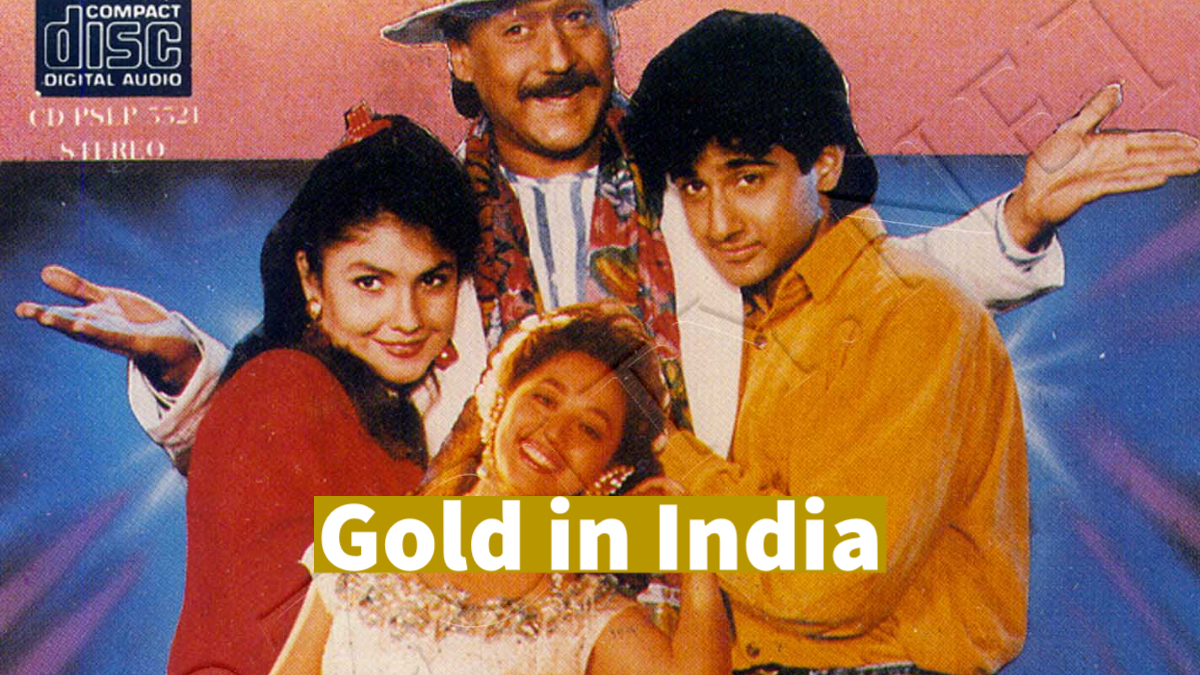

Movie Case Study

The above scene shows Thakral (played by Kamal Chopra) showing off his business of gold to his competitor Natwarlal (Prem Chopra) which he has earned through illegal means. In this blog, Learning Perspectives will explore how are gold prices determined in India.

Factors affecting Gold Prices in India

No marriage in India is complete without gold jewellery. Gold is an essential metal invested in by each household. Gold prices tend to see a change on an everyday basis.

Gold prices are in flux every day, and for those with a curious mind, we have explained the factors that decide what price you will pay for gold in India. There are different factors that affect gold prices in India, including the local tariffs

and duties, the international gold prices, mainly depending on the interest rates.

Imports in India

Since India imports a majority of its gold requirements, the exchange rate and different duties also affect gold prices in India. As a result, gold prices are affected by the demand and supply factors within India. As a result, most gold used

in the country is imported, making import tariffs a major determinant of the price of gold in the country.

Import Duty

Import duties also play a critical role in setting gold prices in India. Since gold is traded in US Dollars on the international markets, any fluctuations in the US Dollars or the Indian Rupee can affect the price of gold in India.

International Prices

International prices certainly influence the price of gold in India, although rates may

not be exactly as international. Not only do the prices of gold vary from one country to another, but the prices of gold also vary from one state to another in India. Gold prices in India are determined in large part by informal processes, since the

Indian gold industry does not have any such kingmaker.

Demand for Gold

We may say gold is quite a significant commodity, particularly in terms of Indian Subcontinent preferences and beliefs, and above all, numerous factors such as those that we discussed, as well as a few others, exert significant influence over the

price of gold in India.

These facts make the rural gold demand the critical determinant in the total gold demand of India, and hence, gold prices too. Industrial demand for gold accounts for 12% of total gold demand in India.

Apart from the aforementioned factors, there are a few more factors such as gold production and its cost of production which affects the prices of the metal.

Demand for gold, the quantity of gold in the reserves of the central banks, the value of the US Dollar, and the desire to hold gold as a hedge against inflation and devaluation of the currency are all factors influencing the gold price in this country today.

Despite being the second largest importer and consumer of gold globally for years, with an annual import of 700-900 tonnes worth $35-40 billion, India is barely the price maker, only a price taker.

How are Gold Prices determined?

Gold prices are decided by multiple banks, a supervisory board, and an inner-party-and-outside-party panel of presiding members, which work out numbers according to demand and supply on gold futures derivatives markets, and establish an average price both at the spot and fixed prices. Algorithms evaluate the same market data used by banks, committees, and derivatives markets, which then creates the gold spot price; it allows for changes in demand, but also any fluctuations in the home currency, such as the Pound, Dollar, or Yuan.

In India, India Bullion and Jewellers Association Ltd. (IBJA) publishes daily Gold AM and PM Rates. These rates are benchmark rates for the issue of Sovereign and Bonds as per various notifications issued by the Ministry of Finance and Reserve Bank of India. IBJA and rates are also benchmark rates for Lending against Jewellery by NBFC and Bank as per RBI notification.

References: https://www.ibja.co/About.aspx