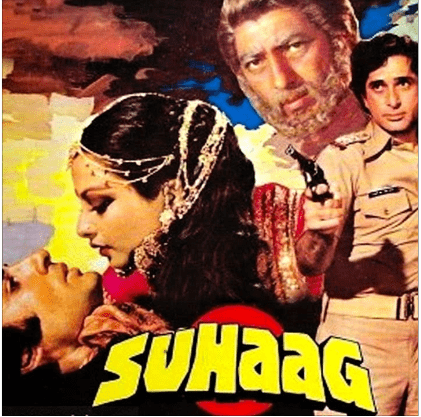

Movie Case Study

The scene that you just saw shows Durga Kapoor (played by Nirupa Roy) giving away her jewellery to Bhaskar (played by Jeevan). Bhaskar has information about his lost son and wants to extract money from her. He asks for some jewellery and she gives away her bangles. Later, he asks her for the mangalsutra which literally translates to auspicious thread. This necklace is composed of gold, yellow threads, and black beads.

In a life-threatening situation, would Durga Kapoor refuse to give her MangalSutra to Bhaskar, if she knew her jewellery was insured? In this blog, Learning Perspectives will explore Jewellery insurance.

What is Jewellery Insurance?

Gold in India is considered a social status. Even though times have changed drastically, love for gold still resides in every Indian. Gold is traded in the form of ETFs (exchange-traded funds), bonds, mutual funds, etc. Gold is considered an investment and it is purchased in the form of jewellery as well. While diamonds in India are not considered the best form of investment. They certainly form a dazzling piece of jewellery.

Insurance companies in India provide coverage for jewellery. These could be in the form of a family heirloom or jewellery with resale value. It is considered risky to keep jewellery at home. Bank lockers are easy ways of protecting jewellery. Although there can be instances when jewellery is subject to risk. This can occur in the following cases:

Jewelry at Risk

- Burglary or theft

- Natural calamities

- Fire

- Items kept at home

- Accidental loss

Keeping jewellery insured becomes more important in certain situations, such as:

- When there is a marriage in the house or a newly-wed couple enters a house. They generally carry jewellery with them.

- Jewellery shop owners.

- People who travel frequently leave their houses vulnerable to threats.

How does Jewellery insurance work?

Jewellwery insurance generally is covered under home insurance. A premium of insurance is decided on many factors such as:

Valuation:

This is a crucial element for understanding jewellery valuation factor. It is calculated through a noted jeweller who provides a valuation certificate.

Research:

Another factor that is important in determining is the research aspect. Conduct a peer analysis to get quotes from different insurance houses. Reading the terms and conditions will help evaluate the coverage provided along with the premium being charged.

A number of items:

A number of items influence the entire valuation of the jewellery.

Coverage extent:

Regular jewellery insurance companies provide only partial coverage. The all-risk coverage will provide 100% coverage which would secure the cost of all the jewellery items insured.

[…] person has secreted about his person any such books of account, other documents, money, bullion, jewellery or other valuable article or […]