Movie Case Study

The scene is a conversation between Amar (played by Aamir Khan) and his father (played by Deven Verma). Amar got an expensive haircut from the Taj hotel which irritated his father. His father claims that the money he earned by cutting the hair of 20 people was lost in a single haircut.

In this blog, Learning Perspectives will explore the meaning of haircuts in finance.

What is Haircut in finance?

In general, a haircut refers to a situation in which we use shortening techniques to remove the superfluous edge and leave the best possible result.

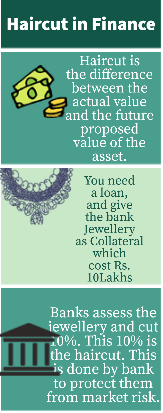

In Finance, banks and other moneylenders use this term when offering loan facilities to an individual or a firm in exchange for security. A haircut is a percentage that represents the difference between the actual value of an asset pledged for a loan as security and the future proposed value that can be borne following the asset’s contingent loss.

In other words, before providing any individual or firm with the suggested loan amount, every bank or financial institution charges a certain percentage ranging from 15-to 60%, standard haircut charges depending on numerous criteria.

For Instance, when an individual requests a loan at a bank, the credit department sets a percentage of the entire amount, before approving the loan. The amount kept with the bank as a portion of the differential amount is called a Haircut. A haircut is an amount with the bank as a fraction of the differential amount.

Understand Haircut in Finance with a Video

Advantages of Haircuts:

- Loans are secured to some level

- Banks and NBFC play it safe and ensure loan repayment

- The lending amount is lowered

- The initial Margin for moneylenders/banks is recorded

Disadvantages of Haircuts:

- Consumer/Borrower settles in less for what he/she owns

- Haircuts vary on the volatility of the collateral

- Forfeiting of the asset in case of default

- Liquidation is possible

- Legal formalities are expensive

Applications of Haircut:

Haircuts can be applied in different situations while applying for a loan or pledging collateral as in like;

Banks: Depending on the nature and size of the investments, banks commonly demand haircuts as fees. This is especially true when an individual’s asset doesn’t hold progressive market value shortly.

Stock Market: Many promoters use their stocks as collateral to increase their financial stability and trade futures, options, and equities to earn huge capital gains. The shares used as collateral are then evaluated for their risk percentage and future values.

Before this, a haircut is applied, which is the total of the whole asset/stock value.

Calculation of Haircuts:

Haircuts are normally set by RBI Guidelines when deciding the repo rate, which is used by the banks to ascertain the proportion of deductions that needs to be made when lending money against collateral.

The basic formula to calculate haircut percentage:

Let’s pretend, that Mr. Ketan needs $10,000 as a loan but his securities are volatile, therefore bank offers $6,000 only as the final loan amount to be disbursed to his account. In this scenario, the haircut is $(10,000 – 6,000) = $4,000 or we can say 40% of total securities’ current value.

Conclusion:

Banks typically demand haircuts based on the risk associated with the securities/collateral. In present market scenarios, the percentage figure may range from 30%-65%, whereas the debt solvency of the country may increase this figure by 10-15%. Haircuts will always be considered a loss for the asset that an individual or a company owns.