Movie Case Study

The scene from the movie shows Vinny & Mark Baum (played by Steve Carell) talking to a risk assessor at Standard & Poor (S&P). Mark confronts her by questioning why the credit rating remains the same for subprime bonds even when the underlying asset has deteriorated. Learning Perspectives will explore the meaning of Credit rating in this blog.

What is Credit rating?

Credit rating is an assessment of credit worthiness of a business or an instrument. Credit rating agencies generally provide credit ratings. These agencies rate and grade the companies on the basis of their financials, management, and future orientation of the business.

What do Credit Rating agencies do?

Scrutinizing financials involves checking whether the company has made its interest payments on time and has the potential to pay the next installments. The scene shows the S&P risk assessor. Some of the prominent rating agencies in the US are Moody’s, S&P, and Global. They provide a rating or a score to the company, instrument, or industry.

Regulators of Credit Rating agencies in India

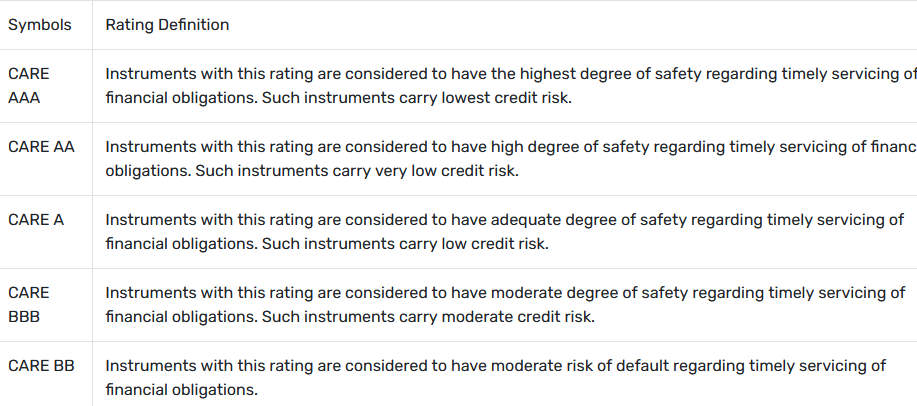

While in India, credit rating agencies come under the purview of SEBI or the securities exchange board of India. The SEBI (Credit Rating Agencies) Regulations 1999 defines rating as ‘an opinion regarding securities, expressed in the form of standard symbols or in any other standardized manner, assigned by a credit rating agency and used by the issuer of such securities, to comply with a requirement specified by these regulations.

A company that assigns credit ratings, which rate a debtor’s ability to pay back debt by making timely interest payments and the likelihood of default. The agencies have Brought revolutionary changes in the Indian capital market by introducing various innovations.

CRISIL, CARE, and India ratings are some of the popular credit rating agencies in India.

A rating outlook can be positive, negative, or stable. Positive indicates a chance for an upgrade in the rating, while a negative outlook can indicate an expected downgrade.

Process of Credit Ratings

Credit ratings generally involve many analyses. If the rating is done for the company, a business risk analysis is conducted.

- Country and macroeconomic Risk

- Industry Risk

- Financial Analysis