Movie Case Study

The scene in the movie shows a conversation between Sapna and the shopkeeper. She (played by Tabu) walks into a departmental store, however, she isn’t very well versed in the metrics of the commodities that she is trying to purchase. She asks for pulses and the shopkeeper asks how much? to which she replies she wants 2 liters of all pulses. The shopkeeper is confused and he mentions that pulses are measured in kilos. Then she asks for 2 kilos of bananas, to which the shopkeeper says that bananas are mentioned in dozens. In this blog, Learning Perspectives explores the meaning of metrics in a business.

What are Metrics in business?

Metrics are the measurement criteria that are used to measure and assess. These can be used to compare different products and services. Kilos, Liters, and dozen are some metrics. Inch is used to measure height, and pounds and kilos are used to measure weight. Similar to how the actor is being told about various measurement criteria by the shop owner. Metrics in general are used to measure commodities and businesses. We will try and understand measurement criteria for various businesses.

Understanding Metrics

Metrics for businesses are very different compared to products. For example, bananas are measured in dozens, milk is quantified in liters, and pulses in kilos. Similarly, measuring criteria for businesses change according to the nature of the business. For instance, a real estate business will be measured differently compared to a banking business. A general rule cannot be applied to both businesses. A business’s stability or instability is measured through financial statements and their interpretation. Interpretation is done through financial ratios and horizontal and vertical analysis.

Example

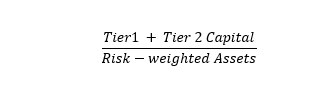

In the banking industry, banks are measured through an important metric called the capital adequacy ratio.

Capital Adequacy Ratio

This ratio measures the capital available in the bank in relation to the risk-weighted assets. The ratio of capital to the risk-weighted assets is measured through basel norms. This ratio

NPA Ratio

Another important metric for banks is the NPA ratio or the non-performing asset ratio. When an individual/company defaults on the payment of the loan then after 90 days of non-payment of the loan, that bad debt becomes an NPA or nonperforming asset.

According to RBI, the system should ensure that the identification of NPAs is done on an ongoing basis. Banks should also make provisions for NPAs at the end of each calendar quarter i.e. at the end of March / June / September / December.

These ratios play a significant role in the banking and in the financial lending industry, however, metrics for the real estate industry are different.

Payback Period

This ratio is important for the real estate industry. It determines when would the property start earning back the initial investment. Hence this ratio becomes a crucial ratio in the real estate industry.

Payback Period = Initial cost of the project/Average annual cash flow of the project

Tenant Turnover

This is an important metric in the real estate industry as it lets the company know the rate at which tenants are leaving. A low turnover is desirable for the company.

Number of tenants moved out/ Total no. of tenants *100

One can see, different businesses require different metrics to be understood. These metrics make it easy for lenders, investors, and customers to interpret the business in a better way.