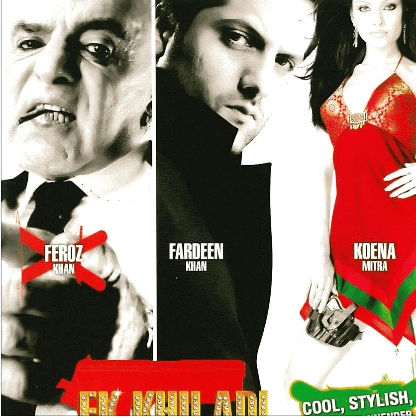

Movie Case Study

The scene from the movie ‘Ek Khidali Ek Haseena’ shows Arjun Verma (played by Fardeen Khan) convincing a senior vice president of the bank. He is narrating how the management of the company happy.com sold off their product to a big company for a large price. In this blog, Learning Perspectives will explore the meaning of divestiture.

What is divestiture?

Divestiture means selling off a part of the company or disposing of an asset of the business. Mergers and acquisitions generally lead to the expansion of the companies. While divestiture generally leads to contraction.

Companies tend to sell off parts that they are not able to handle or selling them would be beneficial. This can be done at a time of closure or bankruptcy too. Sometimes, companies want to discontinue some locations of the business.

Some ways of divestiture include de-merger (spin-off and split-up). and equity- carve out.

Partial Sell-off

A partial sell-off is also called a slump sale, it involves the sale of a business unit or plant of one firm to another. It is the mirror image of a purchase of a business unit or plant. From the seller’s perspective, it is a form of contraction; from the buyer’s point of view, it is a form of expansion.

Sell-Off

Motives of sell-off generally include raising capital, curtailment of losses, and strategic realignment.

A sell-off results in an efficiency gain as well when the unit is divested. Sometimes the value of the part is greater than the whole.

De-Merger

De-mergers result in the transfer by the company of one or more of its undertakings to another company. The company whose undertaking is transferred is called the emerged company. A de-merger can take the form of a spinoff or split-up.

In a spin-off, the division of the company is spun-off into an independent company. The IT division of WIPRO was spun-off as a separate company in the late 80s.

In a split-up, a company is split up into two or more independent companies.